Okay, so I read the entire freaking health care bill (the July 14 version). Here’s a summary, along with some suggestions how to make it better. Yeah, it’s long, but it’s less than 1% of the original, so there’s that.

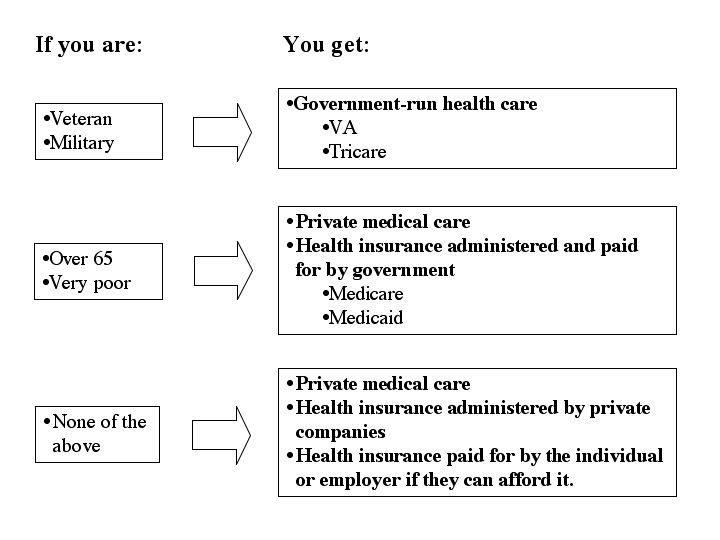

First, here’s our current system, in a handy-dandy chart (unfortunately Dan is busy illustrating the book, so you get my PowerPoint graphics).

- It’s inefficient—for-profit companies must provide a profit to their shareholders. So all else being equal, that they must charge more and pay out less than a government-run entity or not-for-profit company.

- Given that their goal is profit, they must do their best to exclude sick people, deny claims, and drop you if you get sick. So a lot of private health insurance is “junk insurance,” where insurers efficiently take money without actually providing benefits.

- Given the high rate of denials, doctors and hospitals must maintain extra people on staff to fight to be paid. These extra salaries increase overall health care costs.

- And anyway, not everyone who needs private health insurance can afford it. To the tune of 40-odd million people.

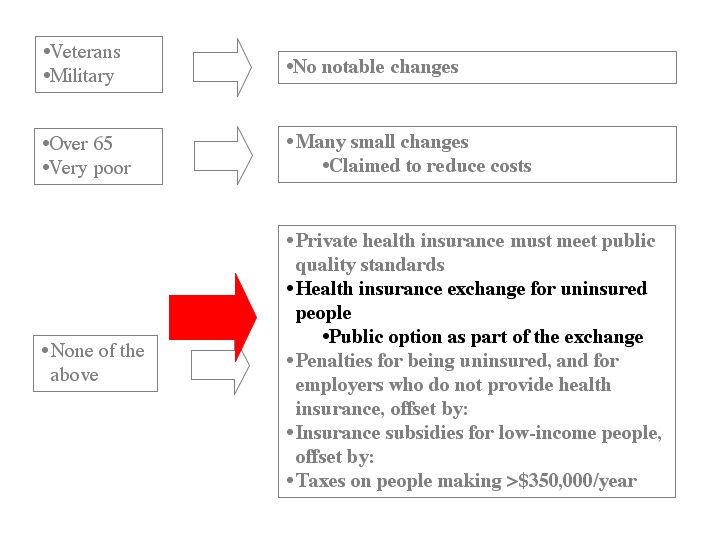

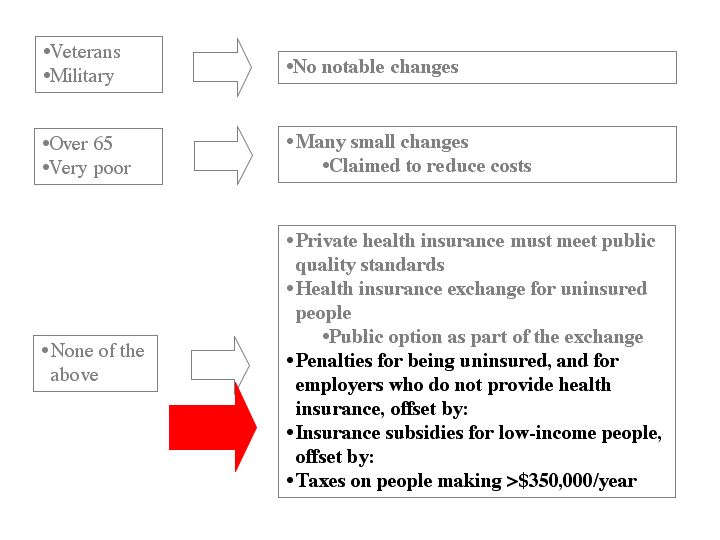

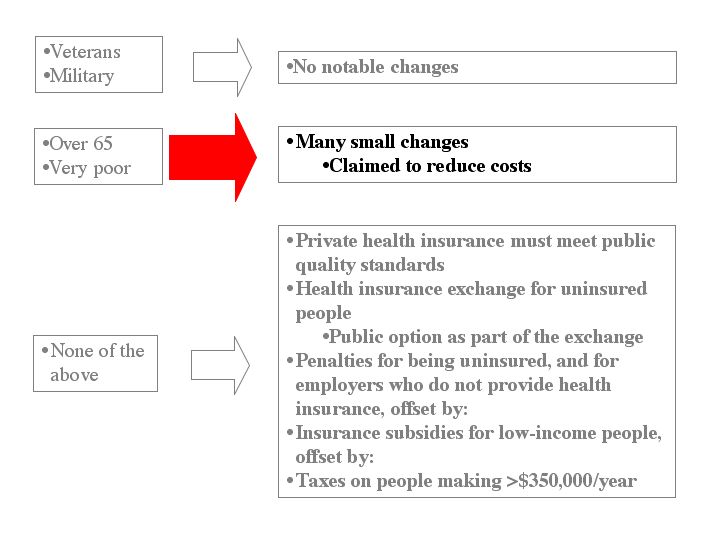

So that’s the situation. Here’s what the current plan will do:

I’ll look at these parts separately, but before I do I’ll repeat a point I made in a previous post: most of this program doesn’t go into effect until 2013, and then there’s a five-year grace period for existing employer-based plans. So if you have a junk insurance plan, it might not stop sucking unholy rocks until 2018, which is more than enough time for lawyers and lobbyists to whittle reform away to nothing. And then the insurance company could choose to “grandfather” your plan, which means that it keeps the old terms but can’t take new people.

Which makes all the “we can’t wait” talk a bit odd–we’re going to wait. Obama, in his speech, said that the four-year delay “will give us time to do it right.” That’s just silly—four years was enough time to build a military from scratch and win World War II with it. And a five-year grace period after that? If the health insurers are really so incompetent that they need nine years to fix their plans, they have no business existing.

So that’s the first big way to improve this bill—there’s no reason not to make Year 1 of this bill 2011 rather than 2013, with no grace period for existing plans and no grandfathering after, say, three more years.

As I’ll detail below, there are some provisions that go into effect earlier than 2013, including some important ones (and one indefensible giveaway to the insurers).

Now, let’s take a look at specifics, starting with:

This is the meat of the bill, and there’s some really good stuff here.

Section 111 says that plans can’t exclude people based on pre-existing conditions. That’s big.

Section 112 says that plans must issue you insurance, and must renew your insurance unless you don’t pay your premiums. And even then, they must provide a grace period for you to catch up.

Also in Section 112, recision (rescinding your insurance when you get sick) is not allowed except for fraud, and per Section 162, the patient has a right to appeal. This goes into effect relatively soon, on October 1, 2010.

Section 113 is a big one: insurers must offer standard rates except some variation for age (no more than 2 to 1), geographic area, and family enrollment. Although I can’t make sense of the specifics of family enrollment—it’s on page 21 if anyone wants to figure it out. (Ha! I slay me.) This means:

- No charging insane premiums for people in poor health, and

- No surcharges when someone gets sick.

That’s a truly well-designed rule—it solves problems, it’s simple, and you don’t need armies of inspectors to enforce it.

However, there’s also a provision for a study to be done beforehand to make sure the rule isn’t too harsh on insurers. It seems to me this almost guarantees that the rule will be eroded to nothing by 2013—of course the insurance companies will say that it’s too onerous.

Section 116 states that if there’s too big a gap between the premiums paid in and the claims paid out (that is, if an insurer takes in twenty million dollars and only pays out five), the excess (to be defined later) is returned to the premium payers, not given out to shareholders.

That may seem technical, but done right it could be huge—it could take away insurers’ incentive to dick patients out of claims, at least past a certain point (because they wouldn’t keep the extra money they save). Instead, they’d have an incentive to keep administrative costs down (paying claims as a matter of course, instead of arguing every one, would be one way to do that) and offer better deals to get more patients on the plan.

Even better, according to section 161a this applies starting January 1, 2011 (like the rest of the bill should dammit).

Section 121-122 says plans must:

- Provide certain essential benefits (doctors, hospitals, outpatient treatments, drugs, rehabilitation, mental health, preventive services, maternity, well-baby care, and well-child care including oral health, vision, and hearing)

- Limit cost-sharing (like deductibles and copays) to $5,000 per individual and $10,000 per family (and can’t have any for preventive services)

- Not impose annual or lifetime limits on benefits

- Only deny benefits based on clinical appropriateness (and not, for instance, cost). Although nothing’s stopping them from arguing that whatever they don’t want to pay for is clinically inappropriate.

All of that’s pretty good, so let’s take a look at a stupid provision, section 164. It provides $10 billion to help group health insurers pay the cost of health benefits to retirees and their spouses and survivors. I can’t see any reason for this except that insurers want taxpayers to pay their obligations. And unlike every other provision in this bill, it goes into effect fast—a mere three months after the bill is enacted. Which shows how quickly insurers can adjust to government actions when they want to.

Anyway, those are the essentials. Here are some possible ways to improve this part of the bill:

- Define a minimum grace period for catching up on premiums (as it reads, the grace period could be seven minutes).

- The ban on recisions is good, but “except for fraud” is a big loophole. I imagine that many state laws forbid recisions except for fraud, but insurance companies still drop cancer patients for not mentioning that they had acne once. Why not make dropping patients (except for nonpayment of premiums) illegal altogether? That saves the expense and bureaucracy of an appeals procedure. After all:

- The act makes it illegal to exclude people.

- So if the insurance companies comply with the law, there’s no reason to commit fraud (like, conceal a pre-existing condition).

- So the only reason someone would commit fraud would be if the insurance companies were failing to comply with the law. In which case, the problem is the failure to comply, not the fraud.

- It’s not clear how the loss ratio (premiums/payouts) will be counted, which leaves open the possibility of financial chicanery (the same way that profitable corporations are broke when the tax man comes)—it’s worth putting in a provision that for public companies, the loss ratio declared to the government be the same as that declared to shareholders.

- We could save a quick $10 billion by letting insurers pay their own damn obligations to retirees.

- Not to be a broken record here, but rather than spending four years studying whether this rule or that is too difficult to comply with, put the system into effect and, if something really does prove to be too onerous, change it then. That’s another reason to have a robust public option—if the administrators of the public option think a rule is too hard to comply with, then change it. If other insurers piss and moan while the public option does fine, screw them.

Phew. On to:

In the exchange, insurers offer plans that the exchange then offers to anyone who’s not already in an acceptable plan (Section 202a).

- Plans must meet all of the requirements listed above. Also, anyone offering premium plans must also offer basic plans (both are defined at length in section 203, 204).

- People who are enrolled in the exchange can join any plan in the exchange (within a geographic area).

- Once you’re in an exchange plan you can stay in it even if you become eligible for another plan. You do lose your exchange coverage when you get on Medicare when you turn 65, or (I think) if you get on Medicaid after a bout of downward mobility (Section 202d4a, 202d4b).

- If you’re poor enough to be eligible for Medicaid, most of the time you’ll be enrolled in Medicaid and not the exchange.

- A state (or group of states) may choose to operate an exchange under the same general terms; such an exchange replaces the federal exchange in that state (Section 208).

Small employers will be able to opt into the exchange, at first ones with 10 or fewer employees, then 20 or fewer in 2014, and larger ones after that at the discretion of the commissioner. (Oh yeah, there’s a commissioner.) An employer remains eligible even if it later grows past the limit (Section 202c).

There are lots of technical provisions about administration, oversight, and things like risk pooling (if Plan A winds up with a bunch of high-risk people enrolled, while Plan B does not, some sort of adjustment will be made where part of Plan B’s premiums go to Plan A. I suppose that’s necessary to ensure adequate outreach to high-risk populations, but it sounds awkward and Jesus Christ can we just have single-payer already?). There may be some crucial weaknesses hidden in these provisions, but nothing raised any red flags for me.

The public option is pretty straightforward, to the point where there’s not much to say about it:

- It will be offered through the exchange (Section 221)

- It must meet the same requirements that the other plans in the exchange do (Section 221)

- It must pay for itself as they do (Section 221)

- It will pay mostly Medicare rates (Section 223)

Section 314 says that insurers can’t push their unprofitable members onto the exchange. I’m not sure why this is even specified—as it stands, insurers can’t dump unprofitable members at all. And if you’re going to specify something like this, you should also specify how it will be enforced, while the bill doesn’t do that.

And that’s pretty much it. In general, the public option is key here—every regulatory safeguard can be evaded or changed, but having to compete with a public option should keep other insurers on the straight and narrow.

There is, of course, room for improvement:

- The exchange doesn’t go into effect until 2013. Better to put it into effect and work out the bugs as we go along; by 2013 we’ll have a much better system.

- You can’t get into it unless you lack “acceptable” coverage, and your existing coverage is acceptable, by definition, until 2018 (and longer if it’s grandfathered). I suppose you could drop your existing coverage to get into the exchange, but not everyone can risk that.

- Why not let anyone enroll in the exchange? It would mean less bureaucracy and government meddling. As it stands, the government has the burden of judging a bewildering array of existing plans to decide whether they’re “acceptable” or not. If anyone could join the exchange:

- The public option would keep other plans in the exchange honest

- Other insurers would have to offer decent plans themselves or consumers would join the exchange.

- Anyway, why should the government decide whether my health care is acceptable? I should be deciding that, thank you very much.

And now, on to the money bits:

Employers are supposed to offer to cover most of the health insurance costs of their full-time employees (72.5% for individuals and 65% for families, Section 311, 312). The contribution is reduced in proportion to hours worked, so an employer can’t get out of the contribution by having two part-time workers instead of one full-time one. And taking the contribution out of the worker’s salary is also verboten.

Employers that don’t do that must pay 8% of payrolls to the exchange trust fund (Section 313). Small employers pay less—nothing at all for employers with payrolls of less than $250,000 a year, increasing in steps to 6% for employers with payrolls of less than $400,000 a year.

Also, people with unacceptable health care coverage will pay 2.5% of their income to the exchange, limited to the cost of an average premium. This will no doubt encourage people to get insurance (you’re paying either way), but penalizing people with no health care is also just a dick move, like when the bank makes you pay money for not having enough money.

And finally, there’s a new tax: It is:

- Nothing if you make $350,000 or less.

- 1% of your income from $350,000 to $500,000. And for all of the whining people will do, I’m sorry—if you’re making $500,000 and can’t spare $1,500, you are clearly too big a bozo to be earning that half-mil in any real sense, so taking it away from you is perfectly just.

- 1.5% of the amount from $500,000 to a million (so if you make $1,000,000 you pay $16,500. Again, deal with it).

- 5.4% of the amount over $1 million.

- That’s if you file a joint return. It’s less if you don’t.

This goes into effect in 2011, creating a cushion of money (and dishonestly making the ten-year costs of the program look better). The first two numbers double starting in 2013 (so someone making $1,000,000 will pay $33,000), but if the Medicare and Medicaid reforms produce decent savings, they don’t (p199). And if the reform produces lots of savings, the government will only collect the 5.4%. This money goes into general revenue (I think).

Sections 452 and 453 give the IRS more teeth to find tax cheats; this seems to apply in general, not just these specific taxes. So, good.

So much for the sticks. Now the carrots: subsidies for people who can’t afford health insurance.

The subsidies are based on family income—they make up much of the difference between the actual cost of an average plan and a specified percentage of your income.

- People at 133% or less of the federal poverty level only have to provide 1.5% of their income; the government covers the rest.

- The percentage rises in steps until someone at 400% of the federal poverty level will paying 11% of their income.

This is welcome recognition that the poverty level is outdated, and that people making many times that much still need help. 400% of the poverty level is $43,320 for an individual, or $88,200 for a family of four.

11% of $43,320 is $397 a month, which is still harsh, but it’s better than it looks—the government pays most of the difference not between that and the average premium (which might be no difference at all) but the real actual cost of a plan, including copays and deductibles.

The credits only apply to people in the exchange, and people with employer-provided health insurance are not eligible. But only real employer-provided insurance counts (where the employer pays most of your premium and doesn’t take it out of your paycheck).

And persons not lawfully present in the United States are unambiguously excluded in Section 242(a)1 and again in Section 246. It’s simply not possible to read this bill and believe that subsidy money will go to illegal aliens. So stick it, Joe Wilson.

There’s a tax credit for small businesses that provide health insurance for their employees.

Now: in his speech, Obama said that “[F]or those Americans who can’t get insurance today because they have preexisting medical conditions, we will immediately offer low-cost coverage that will protect you against financial ruin if you become seriously ill.” Honestly, I can’t see where that is in the bill. Anyone?

So how to improve this section?

- First of all, from a political point of view, putting a tax into effect before a big election year (2012), while waiting to provide the benefit until after the election, is a very good way to lose the election. Seriously, what the hell, Congress?

- The penalty for people who don’t participate solves a problem that may not even come up. Really, if the plan works—if insurers offer good plans and the government helps people out who can’t afford them—we can expect that most everyone will participate. If hordes of people stay out of the system, that means that either the plans suck or they’re not affordable. And if I’m wrong—if many selfish stupid people opt out of a perfectly good system to save on premiums and then demand care on the public dime when they fall ill—we can put the tax into effect then. No need to jump the gun.

- There’s no provision for the cutoffs for small business to increase with inflation. So a few years of bad inflation will be very hard on small businesses—they’ll have to pay taxes designed for larger businesses. Many other dollar amounts in the bill have provisions to increase with inflation (for instance, the legal cost-sharing amounts in section 122).

So much for financials. And you can really stop reading now—you’ve now received most of the wisdom I had to offer. But for the loyal or masochistic, I continue to:

Honestly, this section baffles me—most of it is made up of changes in wording to previous law, which are meaningless in themselves (“Subclause IV is redesignated Subclause VI”) and which would take me another week to figure out. So I’ll limit myself to a few observations:

- This section is a big grab bag of changes with no clear focus. For instance, Section 1413, 28 pages long, improves a website where people can compare skilled nursing facilities.

- Section 1233 covers end-of-life planning. It’s entirely about making sure that the individual knows what options are out there, and that his or her wishes are respected. There is absolutely no possibility that an English speaker, even one as dim as Sarah Palin, could read this and honestly believe that it involves death panels.

- I don’t see where the big savings are expected. For every provision that looks like it should save money (cracking down on fraud, covering tobacco cessation drugs [Section 1712], keeping tighter rein on drug companies’ gifts to doctors [Section 1451], or making Medicare Advantage plans rebate excess premiums [Section 1173]) there seems to be another one that looks like it will cost money (e.g., closing the “doughnut hole” in drug coverage, Section 1181]). One possible exception is Section 1182, which involves substantial discounts on drugs, but it’s not clear to me under what circumstances that applies.

- In general, I just don’t think there are huge savings to be made.

- Depending on which numbers you look at, the average cost of health care per person in the U.S. is $6,000-8000 per year.

- Medicare pays out around $10,000 per year per person. In 2003, Before Bush’s giveaways to insurers and drug companies, that was $7,000 a year.

- Given that the over-65 set needs far health care than younger folks, Medicare is already pretty efficient (at least compared to the rest of our system). It seems to me that aside from repealing Bush’s giveaways (which is a good idea but doesn’t seem to be part of this bill), any meaningful savings would have to come from cutting flesh, not fat.

- Even the writers of the bill don’t seem confident that the expected savings will show up. As detailed above, if the savings don’t materialize, taxes on rich people go up instead. So, there’s that.

Anyway, that’s pretty much all I can say about this section.

There’s also a bunch of miscellaneous provisions, some of which look good (like strengthening our public health infrastructure) but I don’t have much to say about them either. I’ll close with two technical observations:

First of all, the bill was written so that, say, paragraph 142(C)5(d)3 is simply marked with a “3.” Given that each paragraph may go on for several pages, writing the whole number in front of each paragraph would make it much easier for the beleaguered reader to tell what’s going on.

Also, the government doesn’t seem to have any central, definitive, up-to-date online list of laws. So for instance, Section 442 of the health care bill moves the effective date of paragraphs 5, D, and 6 of 864F of the Internal Revenue Code to 2019 instead of 2010. But I have no idea what that means, because the best online version of the Internal Revenue Code (at Cornell) seems to be out of date; the changes don’t make sense with the paragraph 864F as written there. In this day and age it wouldn’t be too hard to maintain a website with the current text of all our laws on it.

Aaaaand I’m done. If you made it to the end, get yourself some ice cream. You deserve it.

Leave a Reply