By Mike Welcome back to our examination of N. Gregory Mankiw’s “ten principles of economics.” (Part 1 of this series is here; Part 2 is here). We got through two principles last time, but today we’ll only manage one. It’s a big ‘un:

Principle 4: People Respond to Incentives

An incentive is, according to my computer’s dictionary, “a thing that motivates or encourages one to do something.” So people respond to incentives, which are things that people respond to. This is a tautology rather than a principle.

Of course, there’s more to it. In the explanatory text, Mankiw points out that keeping incentives in mind is crucial when designing public policy (which is true — unintentional incentives in the tax code in Sweden led to the horror that was Abba’s outfits), and that, for example, a gasoline tax would likely encourage people to use less gasoline (also true). But then he gives this example, which I’ll quote in full.

When policymakers fail to consider how their policies affect incentives, they often end up with unintended consequences. For example, consider public policy regarding auto safety. Today, all cars have seat belts, but that was not true 50 years ago. In the 1960s, Ralph Nader’s book Unsafe at Any Speed generated much public concern over auto safety. Congress responded with laws requiring seat belts as standard equipment on new cars.

How does a seat belt law affect auto safety? The direct effect is obvious: When a person wears a seat belt, the probability of surviving an auto accident rises. But that’s not the end of the story because the law also affects behavior by altering incentives. The relevant behavior here is the speed and care with which drivers operate their cars. Driving slowly and carefully is costly because it uses the driver’s time and energy. When deciding how safely to drive, rational people compare, perhaps unconsciously, the marginal benefit from safer driving to the marginal cost. As a result, they drive mroe slowly and carefully when the benefit of increased safety is high. For example, when road conditions are icy, people drive more attentively and at lower speeds than they do when road conditions are clear.

Consider how a seat belt law alters a driver’s cost-benefit calculation. Seat belts make accidents less costly because they reduce the likelihood of injury or death. In other words, seat belts reduce the benefits of slow and careful driving. People respond to seat belts as they would as they would to an improvement in road conditions–by driving faster and less carefully. The result of a seat belt law, therefore, is a larger number of accidents.

This sounds like blackboard bullshit, but there’s actually empirical support for it (it’s called the “Peltzman effect” from the person who found that yes, people take bigger risks on the road when they feel safer.) My favorite example of the Peltzman effect, as long as we’re talking about Sweden: Sweden switched from driving on the left to driving on the right, overnight, in 1967. Everyone expected a wave of accidents, but instead accidents went down because drivers were paying more attention. Note that this means that we don’t calculate risks exactly–drivers overreacted in that case.

But Mankiw makes it sound like government efforts to improve road safety have been, and must be, futile because drivers will simply adjust their driving to keep the risk constant. That just plain ain’t the case. I’ve read Unsafe at Any Speed, and here are some other problems with Detroit’s cars back then, besides the lack of standard seat belts:

- If you were one of those safety-conscious people who had paid extra for a seat belt, a head-on collision could insert the steering wheel into your face (the steering column was one piece, instead of two shorter pieces connected by a gear).

- Even if that didn’t happen, your seat might break off, hammering you into the steering wheel.

- Brake fluid had a tendency to boil, leaving the brakes useless. By the time anyone checked at the accident scene, the fluid would have cooled, leaving no evidence except the driver’s word.

- The snazzy designs of yesteryear left big blind spots (and a few people were even impaled on those cool tailfins).

- Even outside rear-view mirrors weren’t standard (until 1966).

- In fact, the car companies had only adopted windshield wipers, directional signals, and brake lights (which were standard by the time Nader was writing) under compulsion from the government.

The car companies insisted that they simply couldn’t fix these problems (although somehow they found the resources to completely redesign their cars every year); they only did fix them when government action, or the threat of it, forced them to.And if you think it’s unlikely that we’ve let our driving deteriorate to the point that we’ve offset all of these reduced risks (many of which drivers in the 1960s didn’t even know about), you’re right. Driving is much safer than it used to be. It’s worth remembering just how deadly driving used to be — the economist John Kenneth Galbraith wrote in the 1950s of an “annual massacre of impressive proportions,” and a British person in the 1960s said, “I drive every day. I see blood on the road every week.”Government doesn’t get all the credit; cultural changes have mattered as well (when I was a kid, if you got into an accident, “I was drunk” was considered an excuse). Still, it’s no secret that “the Peltzman effect” does not equal “regulations are futile.” Here’s a 2006 meta-analysis:

As Peltzman (1975) acknowledges, offsetting behaviour could be trivial or substantial. Indeed, the amount varies between road safety measures. Behavioural adaptation generally does not eliminate the safety gains from programmes, but tends to reduce the size of the expected effects.

And that person who saw blood on the road? He was quoted in Richard Titmuss’s The Gift Relationship (1968), describing why he gave blood regularly. And Titmuss’s book is relevant to this discussion. It showed how the blood supply in Britain, where people donated for free and where the distribution was done by a socialist bureaucracy, was cheaper and better than in America, where donation and distribution were rewarded with money. A reviewer summarized the message of the book:

For a lesson in modern political economy, consider the trade in doolb. In the land of Niatirb, the supplie[r]s of this vital commodity receive no pay, and its processing and distribution are in the hands of government bureaucrats. In Acirema, by contrast, nearly all doolb supplie[r]s receive cash or other tangible, individual incentives, and much of the processing and distribution is carried out for profit. Obviously, Acireman doolb supplies will be higher in quality, lower in price, more accurately attuned to demand, and involve far less wastage—right? Wrong.

Point being, “incentive” is a broad term. The desire to do good is an incentive as much as the desire for money. People gave more blood in Britain, where giving was a noble, selfless act, than in America, where it was a troublesome way to make a couple of bucks.

Mankiw doesn’t deny this, but he doesn’t mention it, either. It’s easy to misread this section as saying that our individual, selfish gain/loss calculations are all that matter.

And Mankiw doesn’t mention that taking incentives into account doesn’t always work. Consider crack cocaine. When it first appeared in American cities in the early 80s, it was new, it was scary, and a (somewhat justified) moral panic ensued. The result was the Anti-Drug Abuse Act of 1986, which imposed wildly disproportional penalties on crack (100 times those for a similar amount of powder cocaine). I’m old enough to remember that the idea was to stop crack from spreading. Addicts were expected to look at the incentives and say, “heck, it’s just not worth it. I can get as high as I want to on heroin.” To put it mildly, that didn’t happen. We can conclude that people become crackheads for some reason other than a rational cost-benefit analysis.

And it’s not just crackheads. The Earned Income Tax Credit is a helpful subsidy for the working poor, but that doesn’t mean that people take its incentives into account when making life decisions:

“I mean, Earned Income Credit is nice, but it’s not everything!” said one 25-year-old mother of three. “I’m not going to let it factor into my marriage if I ever want to get married. I’m not marrying the Earned Income Credit. I’m marrying the man I love.”

I’m not creating a straw man here: a lot of public-sector reform in the English-speaking world, and the countries we bully, really has been based on the idea that monetary incentives trump everything. Many still cling to this idea in the face of the fact that these “reforms” haven’t actually made things better.

Grade: C-.

The principle itself is a dull tautology, redeemed in part by some clear explanation of policy consequences, but even that winds up being misleading.

Suggested replacement principle: “Human behavior is a complex thing that is only partly explained by measurable incentives.”

It’s worth pointing out that Mankiw’s errors and omissions so far have all pointed in the same direction–toward a defense of the status quo (redistributing income reduces the size of the pie so don’t bother, environmental regulations do the same so don’t bother, and safety regulations lead to offsetting behavior so don’t bother). We’ll be seeing more of that.

The first four principles were categorized as “how people make decisions,” although they barely scratched the surface of how people actually make decisions. The next three are “how people interact.” We’ll start with them tomorrow.

On to the next post!

By Mike (See Part 1 here).

Okay, we’ve made it through Mankiw’s Principle 1. Onward to:

Principle 2: The cost of something is what you give up to get it.

This sounds like plain common sense, but it’s actually not — Mankiw is talking about the economic idea of “opportunity costs,” which is a more exact way to think about costs. The point is that we shouldn’t analyze costs and benefits in isolation — we have to look at the costs and benefits of the alternatives as well. So, as Mankiw explains, including room and board in the cost of college can be misleading, because you have to eat and sleep either way.

Grade: B.

Nothing worldshaking, but it’s something the reader didn’t necessarily think as clearly about before.

Suggested replacement principle: None.

That was quick. Let’s try another:

Principle 3: Rational people think at the margin. Thinking at the margin means, for instance, taking into account how much of a thing you already have before you buy another. So you might decide that buying a family car is worth the cost if you already have one, but not if you already have three, even though the fourth is the same price as the first three were.

And here’s what Mankiw has to say about rationality:

Economists normally assume that people are rational. Rational people systematically and purposefully do the best they can to achieve their objectives, given the available opportunities.

That’s common sense, right? If your shoes have holes in them, you don’t buy an apple or a ranch, you buy new shoes.

But actually, we *do* buy things that have no rational connection to what we actually want. Think of how things are advertised to us. Yes, sometimes ads inform us that something exists, or that it’s cheaper in one store than in another. But often ads try to associate their products with an image that is designed to bypass our rational mind. And these ads work. So we go to McDonald’s at least in part because of the fun times they show in the commercials, even though we rationally know we’re only going to get “the drab reality of fried meat” (to quote my favorite line in Economix). Or we buy Mountain Dew for the image of thrills, and get no more thrills than we would have otherwise. Or we buy yogurt when we’re really looking for friends. This is not rational, and hundreds of billions of dollars of ad spending suggests that it’s not trivial either.

Even when we want something for rational reasons, there are many ways we don’t go about getting it in the most rational way (Daniel Kahneman’s Thinking Fast and Slow is a great source here). One big one I don’t think Kahneman mentions: We often think of our future selves in the same way we think of other people. So yeah, working out now will give me-in-the-future the big muscles that I want, but screw him. That ain’t rational, but it’s how we think.

Heck, have you ever done something stupid, knowing at the time it was stupid? That ain’t rational either.

For that matter, assuming rationality ignores that rational thought takes energy. So we know that there’s no difference between $3.99 and $4.00 when we stop and think about it. But that missing penny still makes us more likely to buy, because who has the energy to stop and think about it every damn time? Instead we glance at the price, think “three dollars something,” and buy. Heck, it’s not even rational to spend time and effort thinking about it.

Economists are well aware that there’s a problem with always assuming that people are rational, and are exploring more ways where strict rationality doesn’t apply. Mankiw doesn’t even hint at that. So:

Grade: C.

Suggested replacement principle: “It can be useful to assume that people are rational.” It’s not that assuming rationality is useless in all cases, it’s that Mankiw makes it sound like it’s how we should think about human behavior, and it just plain isn’t.

(As an aside, the contrast between economics and advertising is telling. Both disciplines deal with the same subject (how people make economic decisions), and in the 19th century both started from the prevailing idea that people were basically rational. So ads made rational appeals–product A is better or cheaper than product B. The ads often lied, but trying to mislead us with false information still assumes that we act rationally on that information.

But in the late 19th century, Freud showed some of the ways we’re not rational. And in the 20th century, led by Freud’s nephew Edward Bernays, advertisers learned to make image-based, emotional appeals to our irrational minds. Today, that’s what marketing is about — finding ways to make us love our iPhones rather than rationally compare them with Androids.

Meanwhile, economics went right on assuming people are rational.

The difference, I think, is that a new idea in economics is judged mostly on how elegantly it fits in with old ideas, which makes it pretty much impossible to move away from the old ideas (even as every other social science has managed it). By contrast, in advertising a campaign works — it motivates real people to make real economic decisions — or it doesn’t. And science, fundamentally, means checking your ideas against the real world, not against elegant intellectual structures people thought up centuries ago.

So advertising has changed, and economics hasn’t, because advertising is more scientific than economics.)

Anyway.

That’s all for today. Check in tomorrow for more.

On to the next post!

By Mike So a while back I posted about how economics education as it’s usually done can manage to be dull, misleading, and (covertly) political, all at the same time. Which is, after all, why I wrote Economix, which is not (I hope) dull or misleading, and is overtly political.

But there’s always someone who will say that any given criticism of the field, or part of the field, is unfair, that economists don’t really believe X or Y, that you’re taking something out of context or looking at the wrong source, and so on. And sometimes they’re right.

So I thought I’d look at N. Gregory Mankiw’s Principles of Economics. Mankiw (a Harvard professor) is the 29th most cited economist. If there’s a mainstream in economics, Mankiw is in it. His textbook is one of the most popular out there, and judging a field by its textbooks is at least as legitimate as judging it by its scholarly journals.

And we don’t even have to look at the whole book; Mankiw has thoughtfully provided us with with ten principles right at the beginning. This must be the very distillation of what Mankiw–and thus, a large part of the economics profession–thinks is important. Here’s Mankiw saying so:

The study of economics has many facets, but it is unified by several central ideas. In this chapter, we look at Ten Principles of Economics. . . . The ten principles are introduced here to give you an overview of what economics is all about.

Let’s take a look. This is going to be long, so I’ll split it into several posts.

Principle 1: People face trade-offs

This is a good, common-sense rule of thumb–every transaction, for instance, is a tradeoff between giving up our money and not getting the thing we want. But elevating it to a principle is a mistake. In another post I point out that we can sometimes find situations where there’s no tradeoff if we think more carefully. (Buying swirly lightbulbs is a tradeoff between higher up-front costs and lower electric bills, but those bulbs also pump less heat into your apartment. If you buy the swirly lightbulbs and a cheaper air conditioner than you otherwise would have, there’s no tradeoff–you get lower up-front costs and lower bills down the line). We generally don’t think like this, but that’s no reason to ignore the fact that there’s good reason to try.

Again, though, that’s okay as a rule of thumb. But Mankiw doesn’t just state principles; he gives explanatory text for each one. And in the explanatory text for the very first principle, he starts to get into real trouble.

All he’s trying to do is give examples of tradeoffs, and he gives a couple of good ones. But then he says that there’s a tradeoff between a clean environment and a high level of income. According to him, environmental laws increase the cost of producing goods and services, which means more expensive goods and services. (He also thinks that this means lower wages, but that’s silly–a plant that has to hire people to clean up its mess is paying more wages and driving the general wage level up.)

So is there a tradeoff? Sometimes, yes. But remember, waste isn’t just bad for the environment, waste is inefficiency. Reducing inefficiency can reduce waste and costs. For instance, have you noticed that soda bottle tops are smaller than they used to be? That means cheaper bottles (leaving us with more resources for other things) and less waste—when we throw the empty bottle into the nearest dolphin’s eye the dolphin is less hurt. Where’s the downside?

And what about using old fryer grease to power cars? That turns the waste into a resource, meaning less oil extraction, less global warming, and smaller fatbergs.

And in the real world, when nasty old government has twirled its moustache and forced innocent businesses to clean up their own messes, the results have been far better, and far cheaper, than expected–often just the unexpected benefits have outweighed the cost, which is pure gain for society. For instance (according to Barbara Freese’s book Coal):

One economic study found that the Acid Rain program’s improvement of visibility—a benefit barely considered when the law was passed—is alone worth the substantial cost of pollution controls, quite apart from the many environmental and other health benefits.

For that matter, there’s pretty good evidence that getting lead out of gasoline in the 1970s was a big cause of the reduction in crime in the 1990s (as the 1970s babies approached their high-crime years and just didn’t commit crimes, surprising everyone). If that’s even a little true, the purely economic benefits dwarf the costs so much it’s not funny. Literally not funny.

It’s hard to avoid the conclusion that there is not always a tradeoff between a high level of income and environmental protection.

Speaking of efficiency, Mankiw also says that society faces a tradeoff between efficiency and equality. If you take that as a principle, then the most unequal economy is also the most efficient.

That sounds wrong, and it doesn’t sound any less wrong when Mankiw tries to explain it:

When the government redistributes income from the rich to the poor, it reduces the reward for working hard; as a result, people work less and produce fewer goods and services. In other words, when the government tries to cut the economic pie into more equal slices, the pie gets smaller.

This is of course true, in economies where equality is so extreme as to interfere with efficiency. So this is essential information for Mankiw’s many North Korean readers. But in other economies, like–to pull an example out of the air–ours, this doesn’t apply. My evidence is not some smug logic but the real world: Our economic performance, measured by annual real increase in GDP, has not improved as inequality shot up starting in the 1980s. It’s fallen off. It’s not 1-to-1; our economic performance has been falling off since the 1950s, while inequality only started increasing later. But still, where’s the evidence that more inequality is more efficient?

In fact, there’s pretty good evidence that the level of inequality we have is a drag on the economy.

And here’s something interesting: the two examples above are highly political statements posing as neutral, technocratic ones.

So this “principle” doesn’t tell us anything we don’t know, but still manages to be both wrong and political.

Grade: F.

Suggested replacement principle: “People don’t always face trade-offs.” That covers the fact that usually we do, for readers who have been lobotomized, and for the rest of us it’s at least a bit startling and gets us thinking in terms of finding win-win situations.

Phew.

Onward to part 2, here!

By Mike Behold, a comic that explains Obamacare (nearly to death).

It’s here: https://economixcomix.com/home/obamacare.

By Mike You can see it here: https://www.kosmas.cz/knihy/198734/ekonomix/!

By Mike Mother Jones today has one more reason not to buy bottled water: It’s coming from the most drought-afflicted regions of the country.

I’m not saying never buy it. If it’s hot, you’re thirsty, and there are no water fountains nearby, it can make sense to spend $1.50 for a bottle of water. It’s healthier than Coke, after all.

But seriously, if you’re buying it more than occasionally, stop. A little bit of planning (and filtering if the tapwater in your area doesn’t taste great) saves you money and doesn’t take water from where people actually need it.

By Mike Writing Economix took a lot of work—I started in earnest in 2004 and the book wasn’t published till 2012—and the whole time I had a rather loud voice in my head telling me that I was simply throwing away my life.

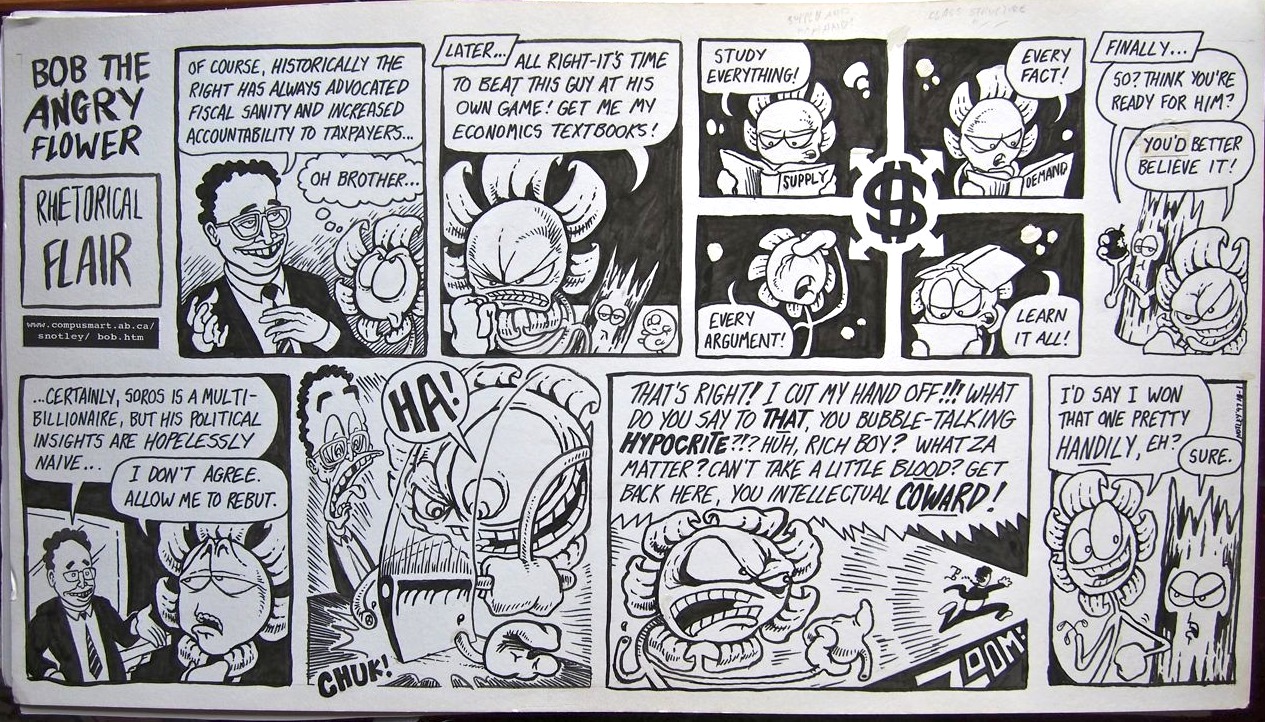

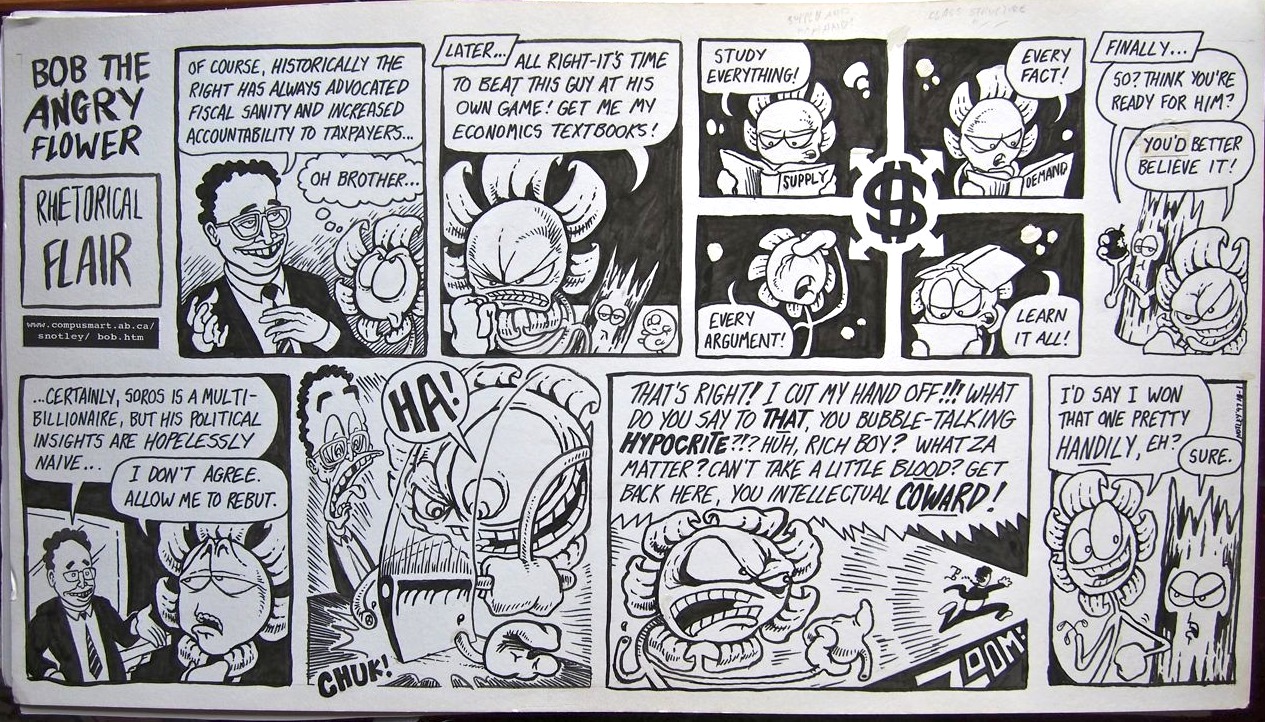

At some point during those years I came across Stephen Notley’s brilliant Bob the Angry Flower. One comic, called “Rhetorical Flair,” especially spoke to me.

I recently contacted Notley about buying the original art, and soon afterward it showed up at my house. And it’s great! It’s much larger and more awesome than I had any right to expect. Check it out:

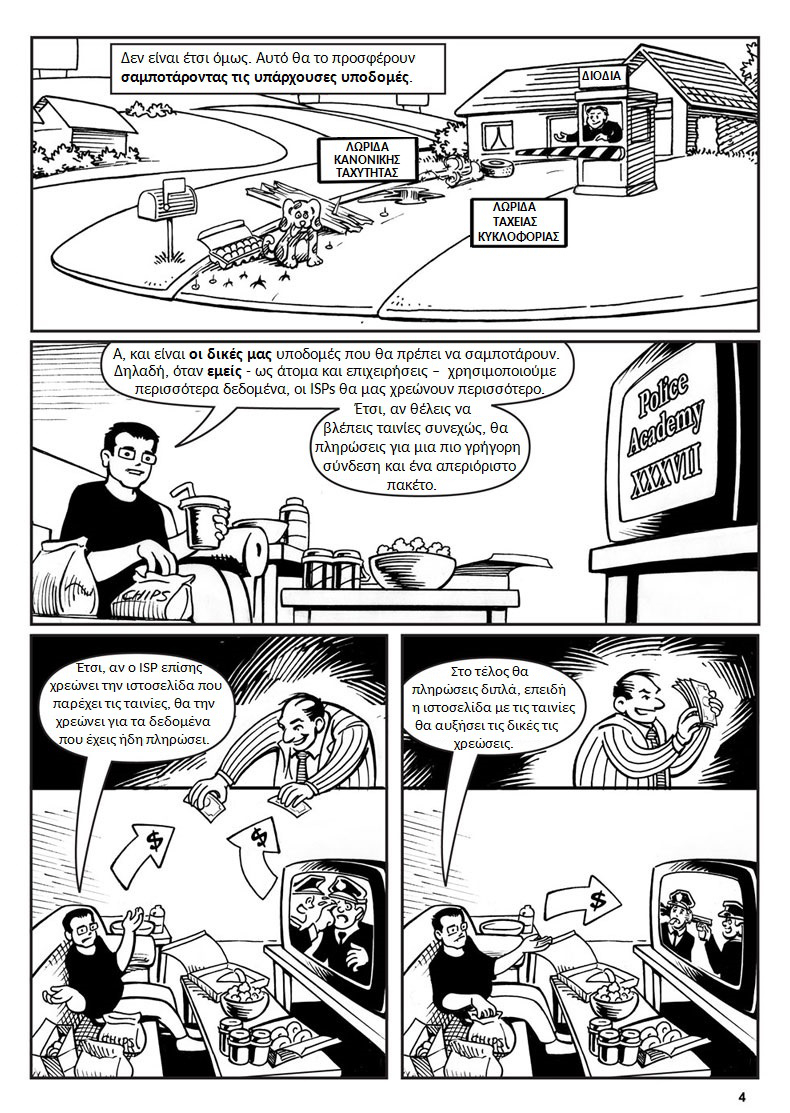

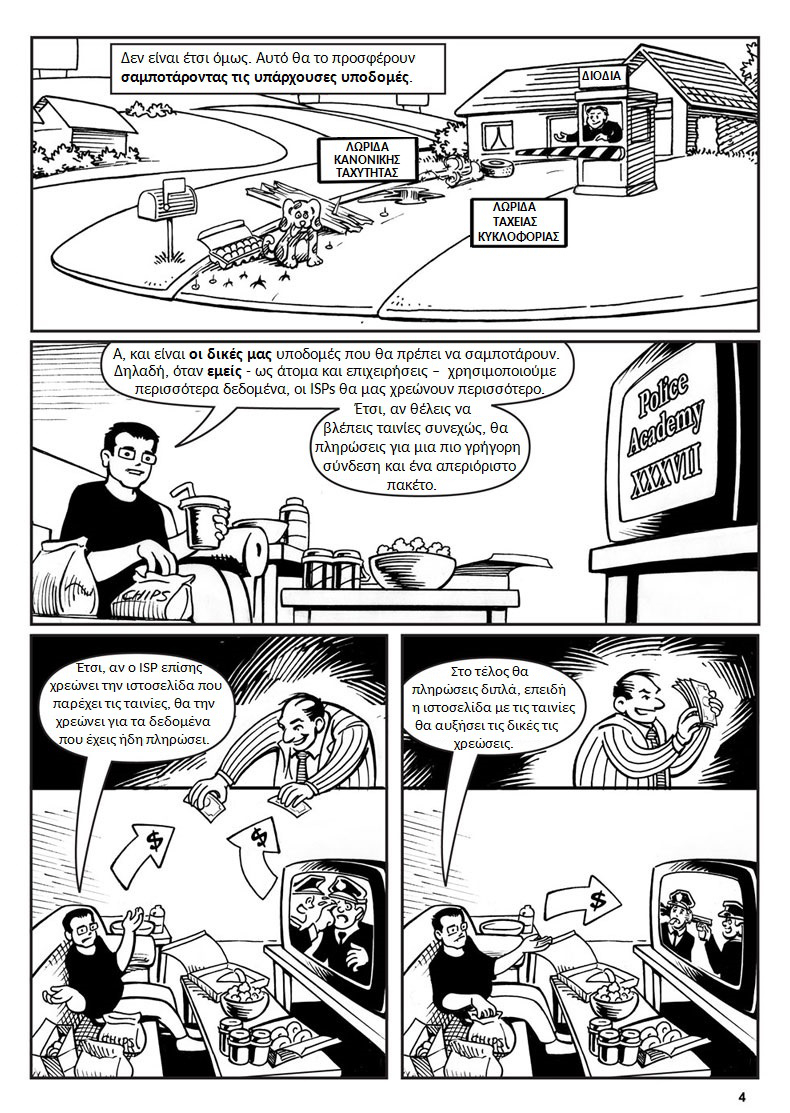

By Mike I didn’t think anyone outside the US would care much about my net neutrality piece–it’s pretty US-centric–but apparently the Pirate Party in Greece cared, so much that they made a translation! It’s here.

And here’s a sample page:

I would have been interested to know what “Spock/Tyrion fanfiction” is in Greece, but they didn’t translate that. It must be universal.

By Mike Behold my take on net neutrality, illustrated by the awesome Ian Akin!

(I have Dan Burr working on a piece on Obamacare, but that will take a while.)

By Mike FDR, who could have been talking about QE, in his first inaugural:

“Faced by failure of credit they [bankers] have proposed only the lending of more money.”

|

|