Behold a piece, illustrated by Ian Akin, about the Republicans’ best plan to replace Obamacare. Spoiler: Their best ain’t good.

This is current as of January 23, 2017, but things are changing fast. Note that there are panel-by-panel references at the end.

EDIT 1/25: As I said, things are changing fast. The Cassidy-Collins bill came out yesterday. My review of that is after this piece.

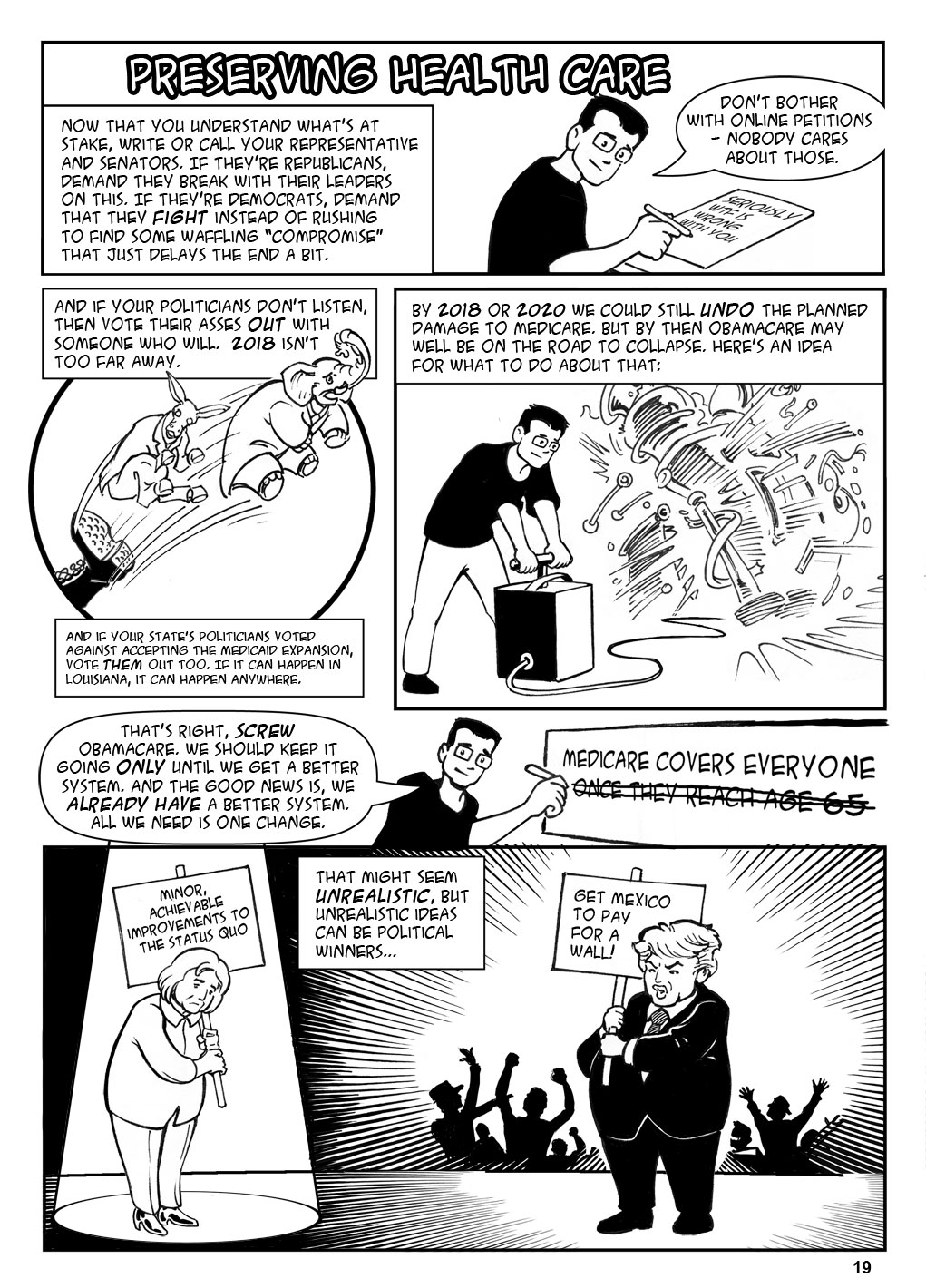

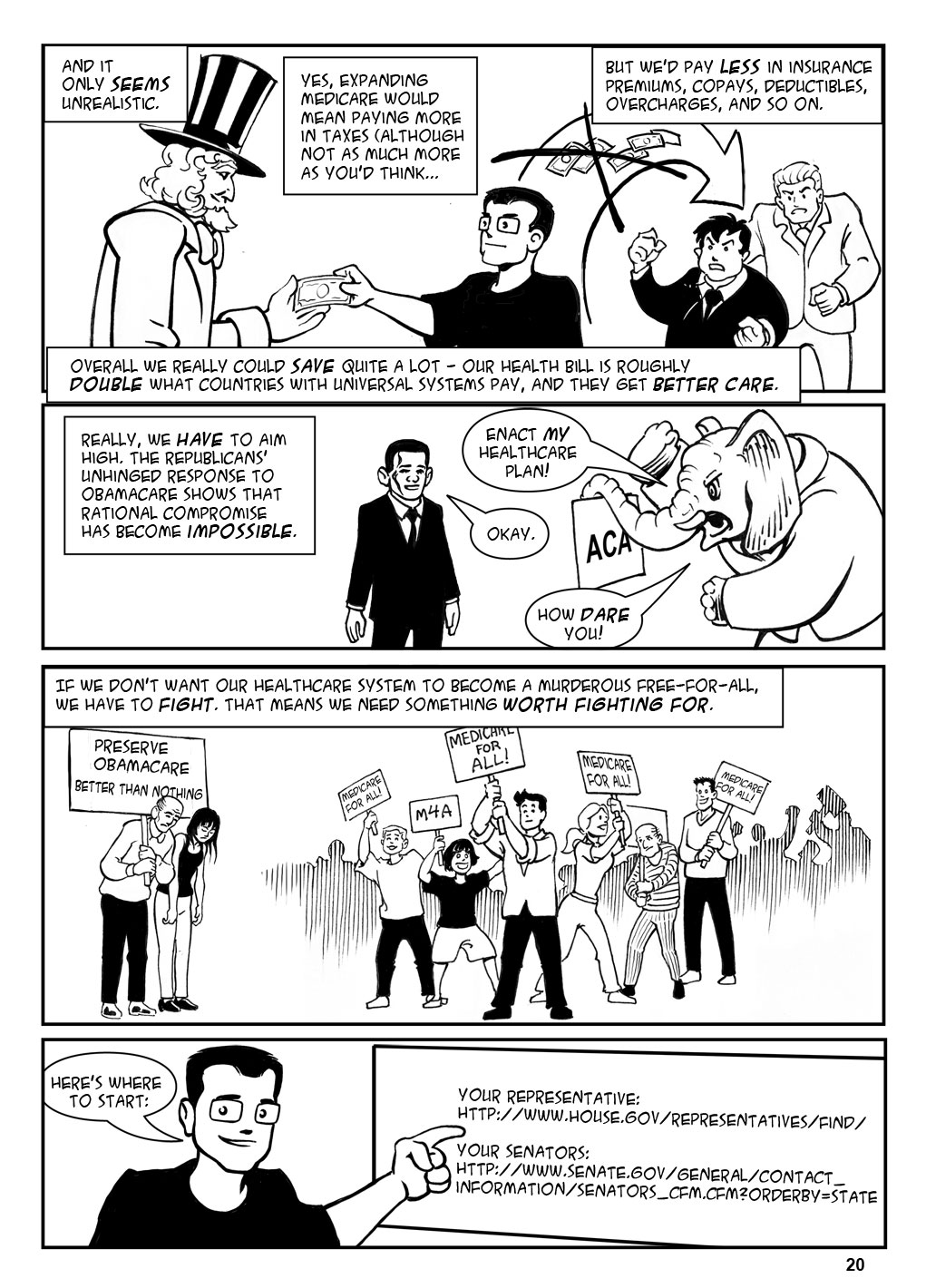

Here are those links in the last panel so you don’t have to type them in:

Your representative: http://www.house.gov/representatives/find/

Your senators: http://www.senate.gov/general/contact_information/senators_cfm.cfm?OrderBy=state.

But calling is better than writing; see here: http://www.attn.com/stories/12768/former-congressional-staffer-explains-how-to-make-congressman-listen?utm_source=facebook&utm_medium=direct-share&utm_campaign=shares.

Okay, my take on the Cassidy-Collins bill:

- One surprising aspect is that it would allow states to keep most aspects of Obamacare if they choose to.

- But this is notional only, given that the White House is actively moving to sabotage Obamacare (see http://acasignups.net/17/01/27/sabotage-trump-kills-final-week-hcgov-ads-effective-nov-1st-obamacare-officially-trumpcare).

- The alternative for states that choose not to keep it is worse than just leaving Obamacare alone, but it’s at least rational. That is, I haven’t seen anything that simply doesn’t make sense or isn’t paid for. In fact, the bill could help some people who aren’t being helped today, assuming that some states that rejected the Medicaid expansion just to fuck with Obama would accept this bill’s replacement, which isn’t as good as the Medicaid expansion but is at least not Obamacare. The alternative would be okay for young, healthy people, who would get high-deductible catastrophic coverage plus some money in an HSA, which is really all you need when you’re young and healthy. But it would be a disaster for people with chronic conditions, who have high expenses every year instead of a single catastrophe once.

And speaking of paid for:

- The bill has zero chance of passing this Congress, because it doesn’t void Obamacare’s taxes (see: rational). So there is still no replacement for Obamacare on the horizon. I’m not even going to do a comic about it, because it’s just not going to pass. See, for instance, Rand Paul here: http://www.vox.com/policy-and-politics/2017/1/26/14399052/obamacare-rand-paul-replacement.

Anyway, if you liked this, check out some of my other comics, explaining:

Social Security (2012)

Net Neutrality (2014)

The Trans-Pacific Partnership (2014)

Obamacare (2014) and a follow-up in 2015.

I also have a book giving the entire history of the economy! There’s a free preview (the Adam Smith section) here.

And check out the artist’s site!

Now, as promised, the references:

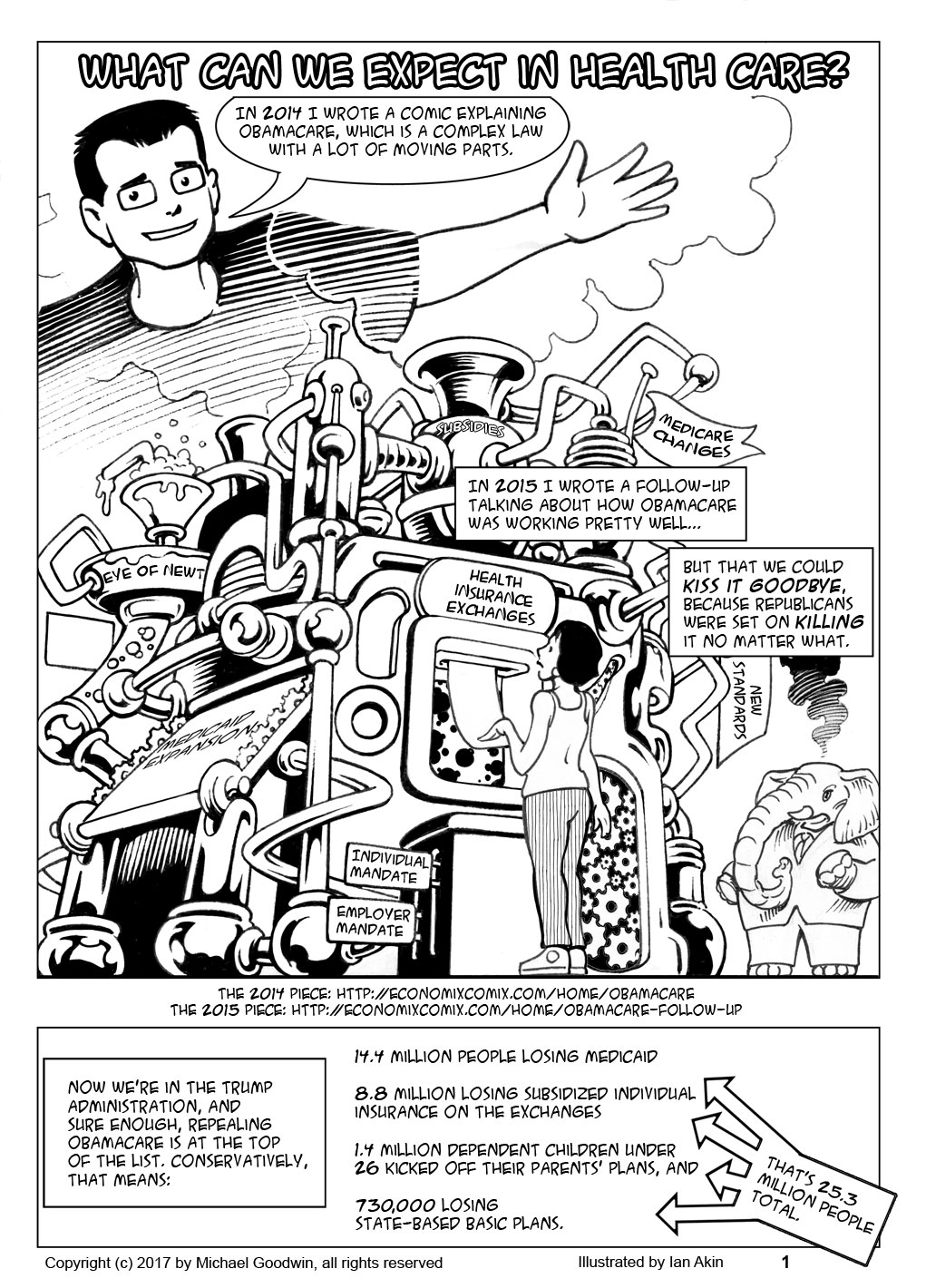

Page 1 panel 2: The numbers are from Charles Gaba, a superinformed health insurance blogger (his estimates of ACA signups were better than anyone’s). They’re at https://www.healthinsurance.org/blog/2016/11/30/please-take-away-my-health-coverage/. Other estimates, eg, the CBO’s, are even higher (https://www.cbo.gov/publication/52371), but I actually trust Gaba more on this. UPDATE: Gaba himself points out that he has updated numbers; the new #s are (in order) 14.4 million losing Medicaid, 8.8 million losing subsidized insurance, 1.4 million children under 26, and 730,000 losing state-based basic plans. For a total of 25.3 million. This is now fixed.

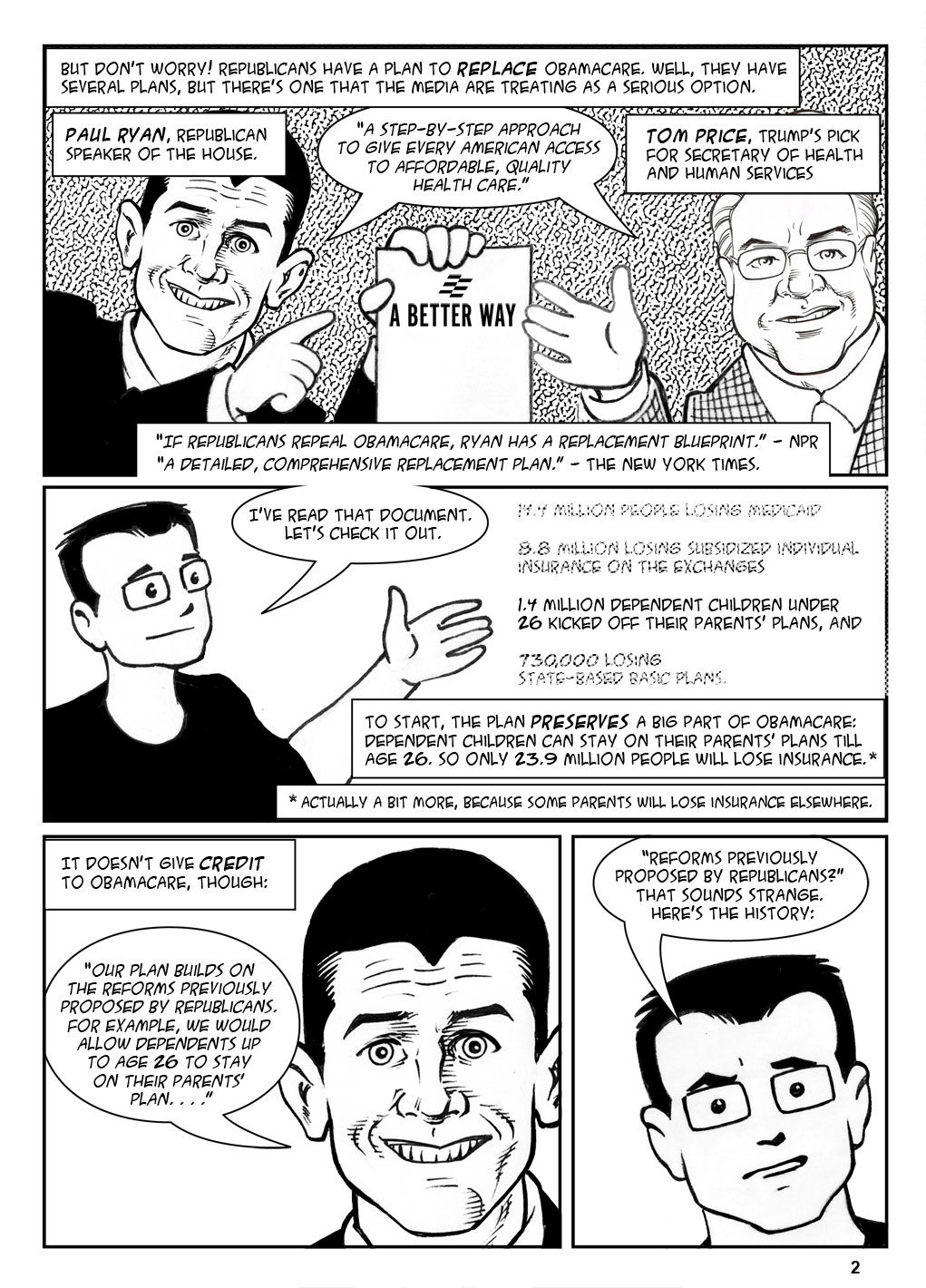

Page 2 panel 1: A Better Way is actually many documents on many subjects; the health-care related ones are available at http://abetterway.speaker.gov/?page=health-care. The Ryan/Price quote is from the Health Care Snapshot, page 1. The NPR quote is from the title of Alison Kodjak’s article of November 21, 2016 (http://www.npr.org/sections/health-shots/2016/11/21/502612264/if-republicans-repeal-obamacare-ryan-has-replacement-blueprint); the New York Times quote is from Robert Pear, “Tom Price, Obamacare Critic, Is Trump’s Choice for Health Secretary,” New York Times, November 28, 2016. (https://www.nytimes.com/2016/11/28/us/politics/tom-price-secretary-health-and-human-services.html?_r=0) Pear in fact is saying that this is just the latest iteration of Price’s plan, the implication being that he’s had a detailed, comprehensive plan all along.

Page 2, panels 2, 3: The big A Better Way document is the policy paper (see link above); the quote is on page 20 bullet 2.

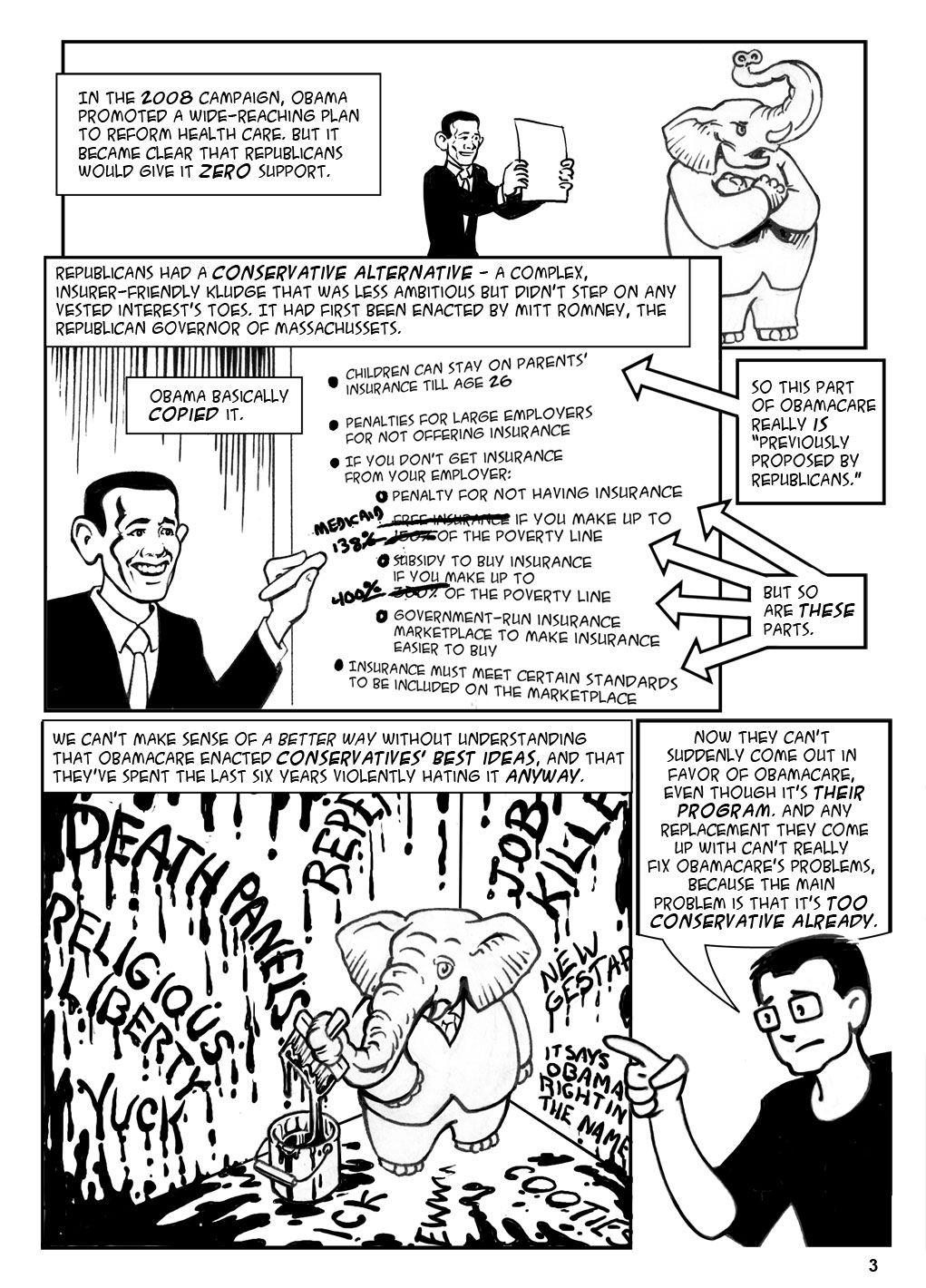

Page 3 panel 1: Obama’s original plan was never fully fleshed out; here it is, such as it was: http://www.cbsnews.com/news/obama-unveils-universal-health-care-plan/. It’s also referenced here.. Note that it includes a public option, which Obamacare does not.

Page 3 panel 2: A fuller comparison is here.

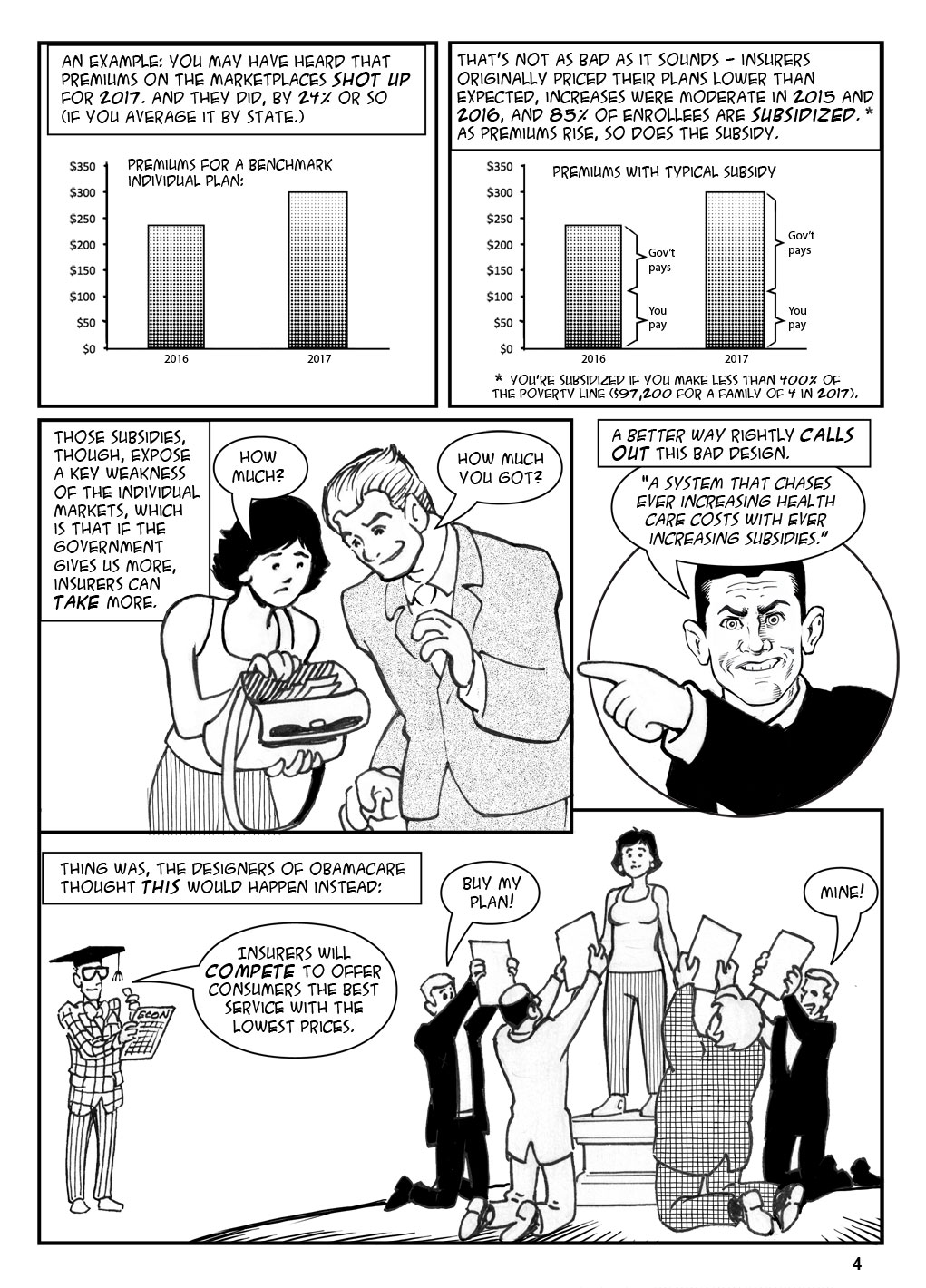

Page 4 panel 1: Premiums: http://fortune.com/2016/10/25/obamacare-insurance-premiums-2017-healthcare/

24%: I took the state-by-state numbers here and averaged them. I did not weight by state population.

Page 4 panel 2: Lower than expected and 85%: http://money.cnn.com/2016/10/24/news/economy/obamacare-premiums/.

Premiums after subsidy:

http://kff.org/health-reform/issue-brief/2017-premium-changes-and-insurer-participation-in-the-affordable-care-acts-health-insurance-marketplaces/

Page 4 panel 4: Quote is from A Better Way policy paper, p14, paragraph 6.

Page 4 panel 5: The fact that Obamacare assumes competition among insurers is mentioned in Dafny, below; it’s also clearly the only reason anyone would think the exchanges are a good idea.

Page 5 panel 1 (the text box): Leemore S. Dafny, “Are health insurance markets competitive?” American Economic Review, September 2010, 1399-1431. The author proves: no, they’re not, and the fewer insurers there are the less competitive they are.

Page 5 panel 2: More competitive the more insurers there are: Dafny, above.

Only one insurer: 21% of enrollees will only have one choice in 2017, up from only 2% in 2016: http://kff.org/health-reform/issue-brief/2017-premium-changes-and-insurer-participation-in-the-affordable-care-acts-health-insurance-marketplaces/. Note that since subsidies are based on the price of the second-lowest-priced silver plan in a given marketplace, one insurer can simply set the subsidy price high by pricing that specific plan high.

Page 6 panels 1,2: A Better Way, Policy Paper, page 12 para 6.

Page 6 panel 3: Policy Paper, page 13 para 4 (not counting bullets).

Page 6 panel 4: Policy Paper, page 16 para 1,2.

Page 6 panel 5: Policy Paper, page 12 para 6.

Page 7 panel 1: Common freaking sense.

Page 7 panel 4: One thing I don’t mention is the Republican obsession with health savings accounts, when you can put money away, tax-free, and then spend it on your health care costs. A Better Way talks about these like they’re the Second Coming. In fact, there’s nothing wrong with HSAs, but they’re not a solution. For one thing, the tax benefit depends on your tax bracket; it helps the rich save a lot, and the very poor not at all. For another, you have to have money to put away in the first place. A Better Way does say that any excess from the universal subsidy after you’ve bought health insurance can be put toward an HSA, but I can’t see many people having an excess when they’re only getting enough money to buy a 2009 plan.

Page 8 panel 1: Policy Paper, p14 para 2

Page 8 panel 2: Policy Paper, p14 para 2.

Page 8 panel 4: Trillion-dollar tax cut: Policy Paper p12 Figure 2 (“more than $1 trillion.”) Focused on the very rich: Representative Jeff Duncan has the list of Obamacare tax hikes here; even though Duncan is trying to argue against these taxes, it’s clear that they fall mostly on the wealthy.

Page 9 panel 1: Here’s A Better Way on wellness programs: “Sadly, the Administration continues to stand in the way of these commonsense programs. Legal challenges and burdensome regulations have undermined employers’ ability to offer wellness programs, leaving them in a perpetual state of uncertainty.” The only reference is to EEOC vs Honeywell, a legal challenge brought when Honeywell charged workers, and their spouses, $1000-$1500 for not undergoing biometric testing. (see https://www.law360.com/articles/619521/is-eeoc-wellness-program-litigation-making-you-sick). Point being, EEOC has a problem with employee wellness programs when they’re effectively not voluntary or when they’re a way to screen out disabled people, and they should.

Malpractice suits: This is supposed to keep costs down by cutting down on “defensive medicine” (unnecessary testing done to cover the doctor’s butt). But there’s basically no difference in test rates in states that instituted broad protections against malpractice suits: http://www.nejm.org/doi/full/10.1056/NEJMsa1313308#t=article.

Page 9 panel 2: $13 billion: Average of 10-year costs of the cost-sharing subsidies, see p12 Table 2 here.

$43 billion: 45% of the costs of the Medicaid expansion after 2019 (from the source above), averaged over 10 years (a bit overstated because the amount won’t fall all in one year).

Page 9 panel 3: 138% or less: http://obamacarefacts.com/obamacares-medicaid-expansion/. Depending on how you calculate it it can also be reported as 133%; see, for example, here

Page 9 panel 4: 90% perpetually: See, for example here. Some sources say that the feds will pay only till 2022, but that’s a misunderstanding of a government cost projections that only evaluated the cost of the subsidy till 2022 (rather than having the subsidy end in 2022).

Page 10 panel 1: That’s not quite an exact quote; The Policy Paper says “To prioritize the most vulnerable in Medicaid, starting in 2019, the enhanced FMAP for the expansion adult population in Medicaid would be slowly phased down each year until it reached a state’s normal FMAP level.” (page 27 paragraph 1) The “normal” level is 55%. Date cutoff: Page 26 last paragraph.

Page 10 panel 4: A Better Way, Policy Paper, p28 para 3.

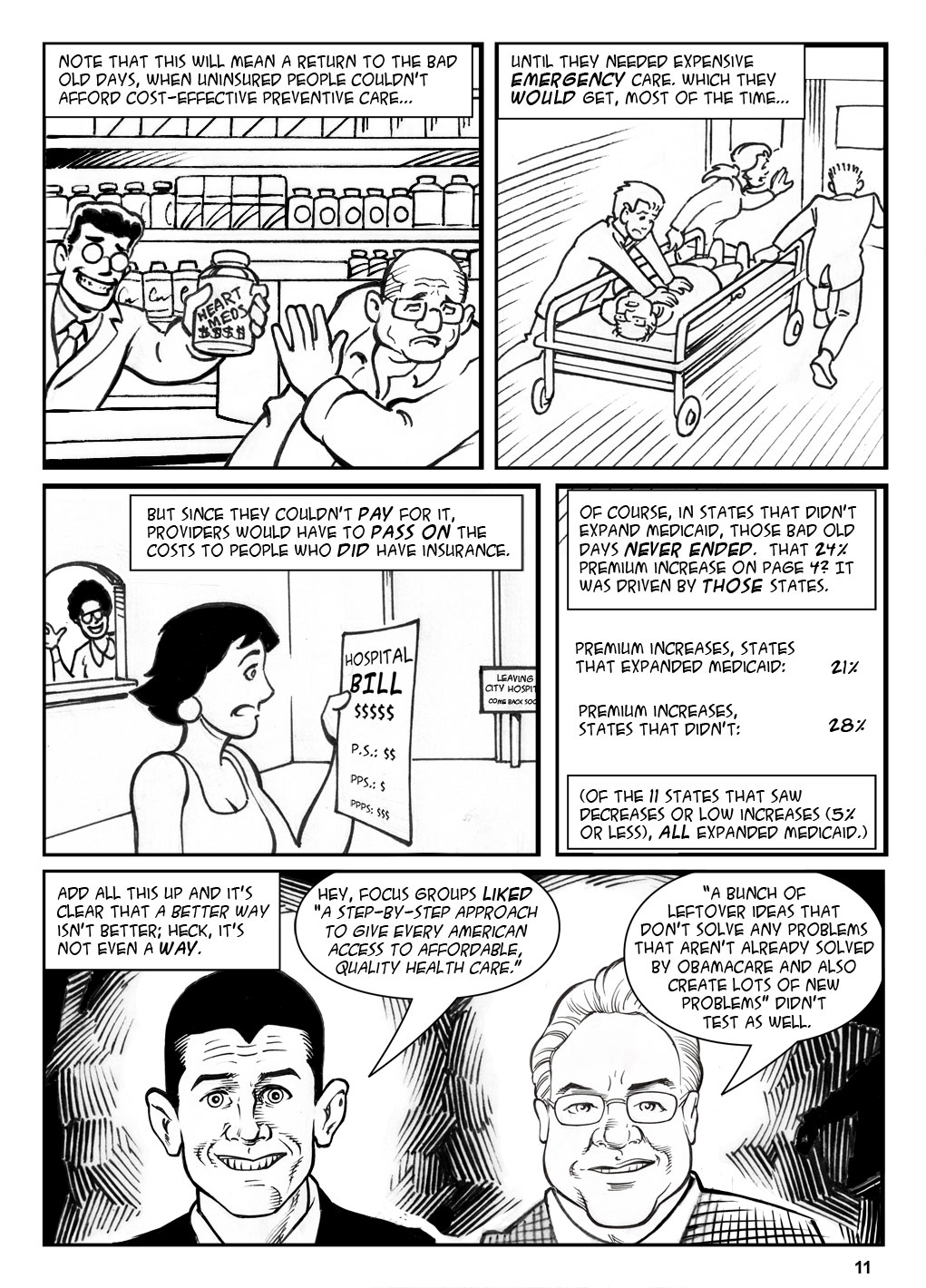

Page 11 para 4: I took the same data as page 4 panel 1 and calculated separate averages for the states that did and did not expand Obamacare. Remove Arizona as a wacky outlier and it goes down to 16% for states that did.

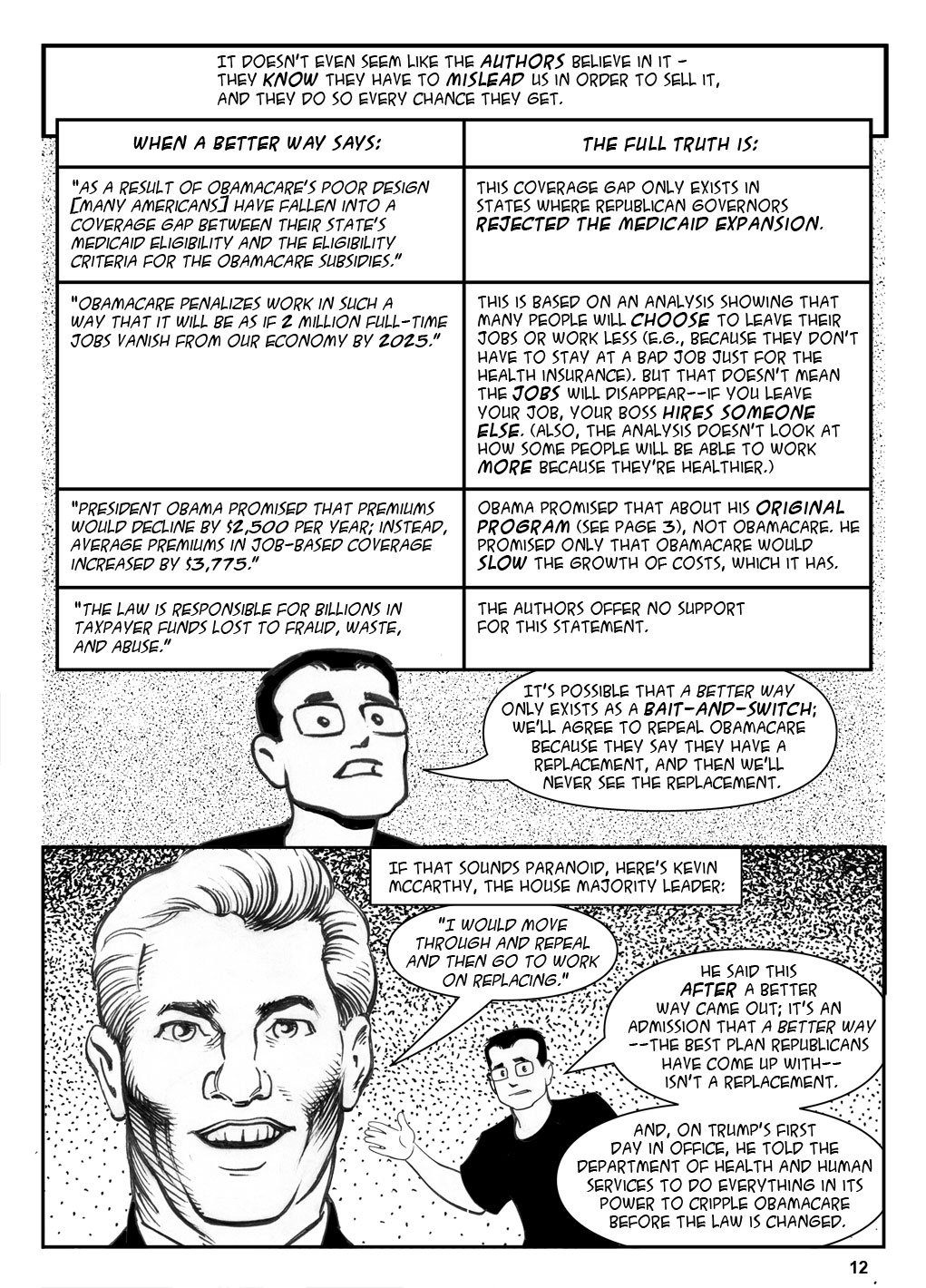

Page 12 Table, Row 1: A Better Way Policy Paper p14, para 5. I’m not saying that nobody is left behind with Obamacare as designed, but there is no “coverage gap between their state’s Medicaid eligibility and the criteria for the Obamacare subsidies.” The only time that happens is when a state rejected the Medicaid expansion, which Republicans had to sue to allow. So the “poor design” is that the law didn’t stop them from going to the Supreme Court to cripple it.

Page 12 Table, row 2: A Better Way Policy Paper p14, para 6. This is referenced to Harris E, Mok S, How CBO estimates the effect of the Affordable Care Act on the Labor Market. Congressional Budget Office, Dec 2015. But that document makes it clear that the estimate is based, not on employers providing fewer jobs, but on effects that “reduce the amount of labor that workers choose to supply.” (Harris & Mok, p1). Why that’s seen as a bad thing is a long story and beyond the scope of this piece. Also, the “Obamacare is a job-killer” thing has been going on for decades. Check out what’s actually happened to jobs since 2010 here.

Page 12 Table, Row 3: A Better Way, page 9 para 1. The reference they use (http://www.politifact.com/truth-o-meter/promises/obameter/promise/521/cut-cost-typical-familys-health-insurance-premium-/) only finds this claim in 2008 and I haven’t been able to find a later one.

Obamacare has slowed the growth of costs: http://www.factcheck.org/2015/02/slower-premium-growth-under-obama/

Page 12 Table, Row 4: The statement, on page 10 of the Policy Paper, is maybe kinda sorta referenced to Figure 3 on page 11 (which is a text list), but that’s mostly whining about Obama either delaying aspects of Obamacare—which shouldn’t upset them if they don’t like Obamacare—or tweaking minor bits, which is necessary for any new program. Yes, he made these changes without Congressional authorization, but that’s what you gotta do when Congress refuses to do anything at all.

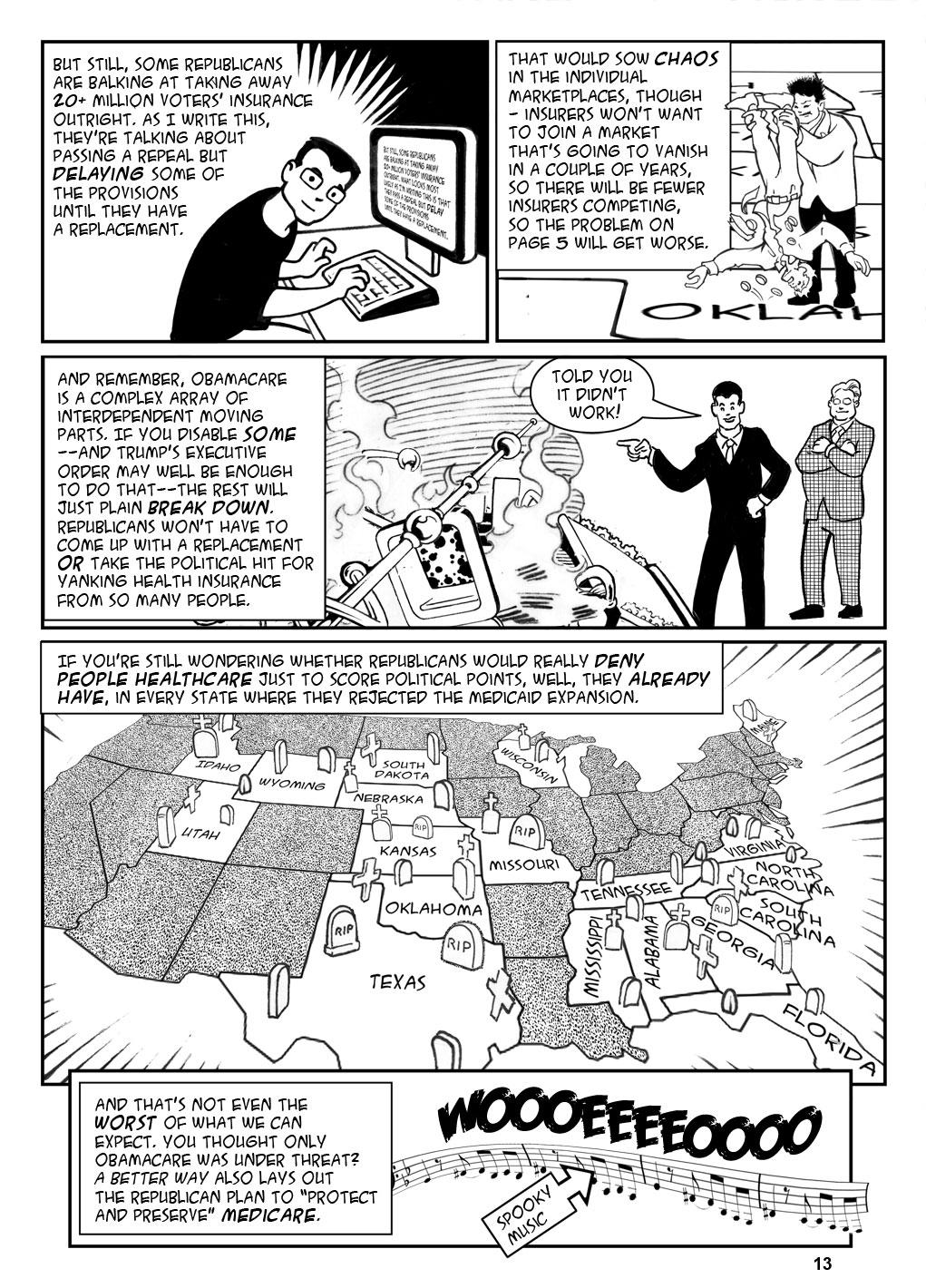

Page 12 last panel: http://www.bigstory.ap.org/article/e6806f9c03a04218b37bbe946f4ee493/gop-could-repeal-replacing-obamacare. Trump’s executive order is available here.

Page 13 panel 3: “Told you it didn’t work” isn’t my prediction–it’s their open plan: http://acasignups.net/17/01/22/gop-openly-admits-they-plan-blame-consequences-their-actions-obama.

Page 13 last panel: An up-to-date list of places that did and did not expand Medicaid are here: http://kff.org/health-reform/slide/current-status-of-the-medicaid-expansion-decision/

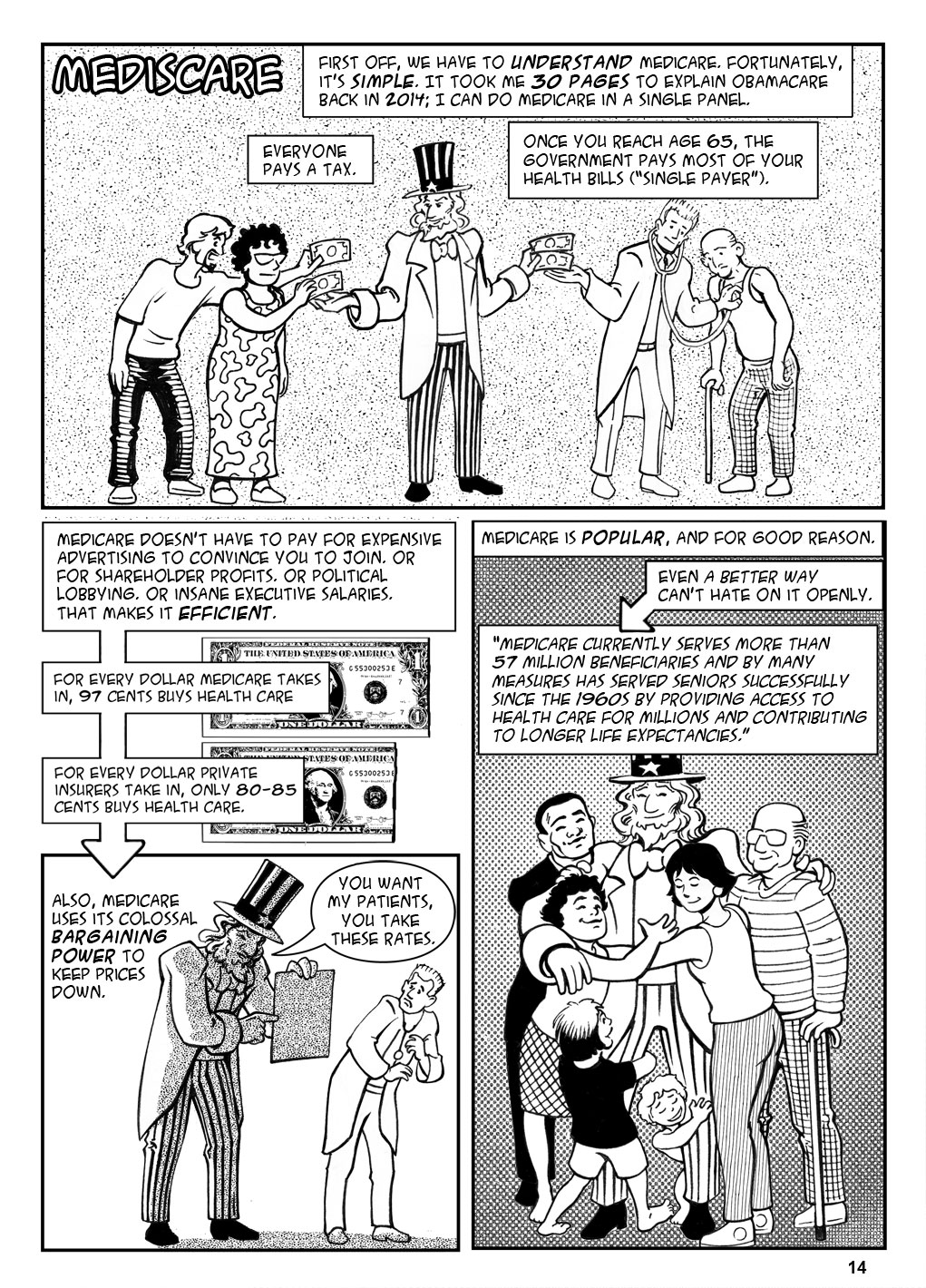

Page 14 panel 1: There’s of course more to it than that—there are four parts of Medicare covering different parts of your health care, recipients pay a small premium, you can get a private Medicare Advantage plan rather than the usual FFS plan, and so on, but that’s the gist.

Page 14 panel 2: 97 cents: Congressional Record, here; 80 to 85 cents: This is what Obamacare demands of private insurers, see https://www.cms.gov/CCIIO/Programs-and-Initiatives/Health-Insurance-Market-Reforms/Medical-Loss-Ratio.html. If insurers were left to themselves it would be lower.

Page 14 panel 3: All insurers do this to some degree, but Medicare does it better; in fact, the best many private entities can do is to simply agree to pay Medicare rates plus 20%. (See here: https://www.proformative.com/questions/self-insured-healthcare). There’s also the fact that under Medicare, your provider can only come after you for your share of the adjusted price. So for example, my father needed cancer treatment with a list price of $50,000 a month. Medicare knocked that down to $10,000, then paid 80%, leaving my father with a bill of $2000 a month and not $42,000. Still a lot, but something we could cope with

Page 14 panel 4: A Better Way, policy paper, page 30 para 2.

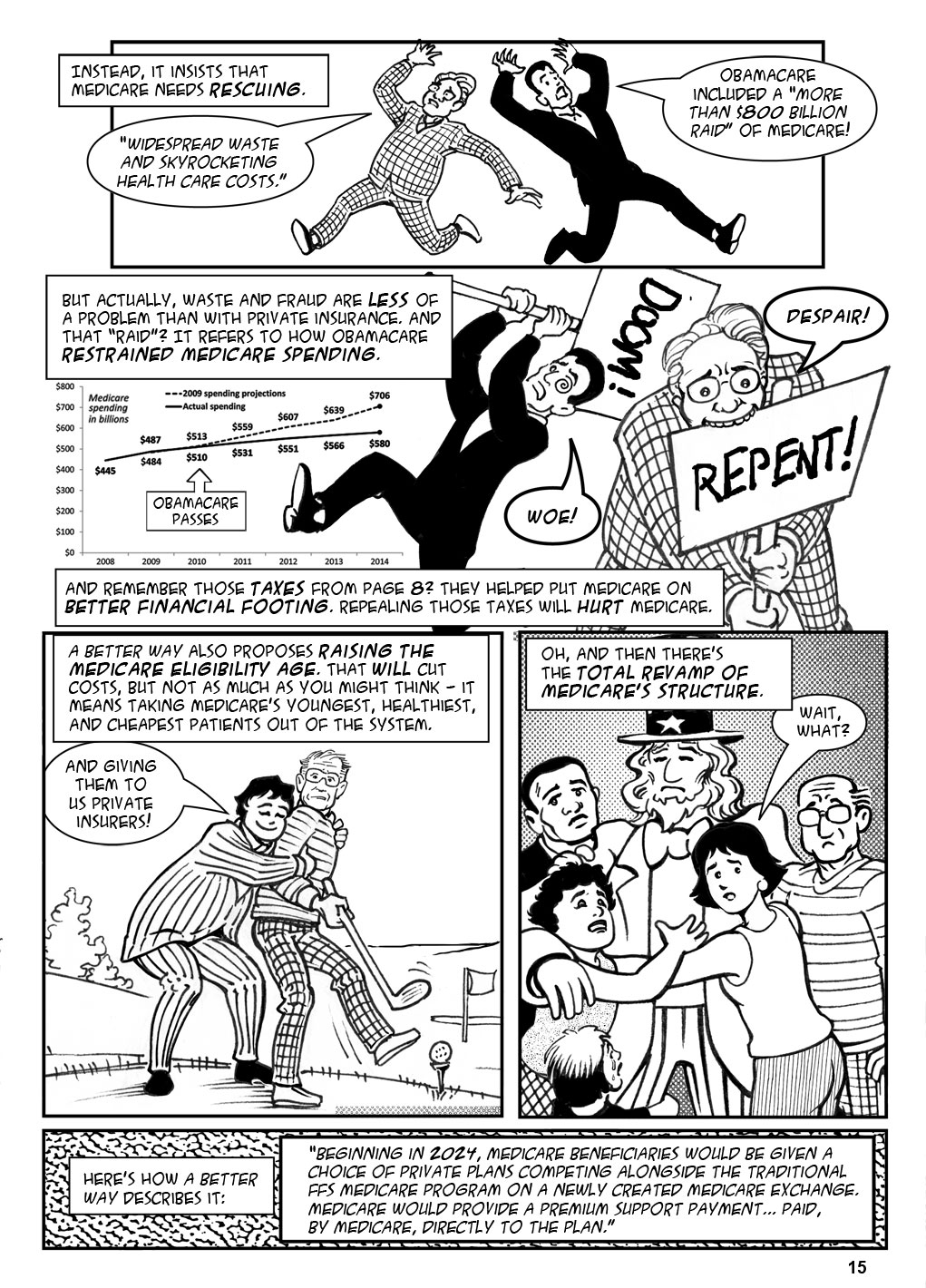

Page 15 panel 1: “Widespread waste” quote: A Better Way, policy paper, page 36 last para. Raid quote: A Better Way, policy paper, p30 para 3.

Page 15 panel 2:

Waste and fraud are less of a problem than with private insurance: It’s not generally understood that when right-wingers freak out about Medicare fraud, they’re (deliberately) misconstruing the government’s estimates of “improper payments.” An “improper payment” may be too low, too high, incorrectly coded, or insufficiently documented. PLUS, if an improper payment is made, the entire payment is counted. If Medicare pays $12,000 for a procedure that should cost $10,000, that’s counted as a $12,000 improper payment, not a $2,000 one. If the government pays the correct amount of $10,000 but with insufficient documentation, or with improper coding, that counts as another $10,000 each time. If the government pays $8,000 for a $10,000 procedure, that’s an $8,000 improper payment. In no case are we necessarily looking at fraud. See https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/CERT/Downloads/MedicareFeeforService2015ImproperPaymentsReport.pdf. Private insurance, meanwhile, doesn’t advertise their screwups like the government does, and Medicare avoids an entire category of fraud—fraud committed against us when a private insurer decides to deny a legitimate claim in order to save money.

The “raid” statement refers to restrained spending: See a similar statement parsed here: http://www.politifact.com/truth-o-meter/statements/2015/aug/07/mike-huckabee/obamacare-robbed-medicare-700-billion-says-huckabe/. The statement is referenced to the 2015 Medicare trustees’ report; that report does in fact state that Obamacare’s changes to future payments means that payments may not be enough in the future. See page 259 para 1 of the 2015 Trustees’ report. Point being, Medicare spending has been restrained; the difference of opinion is whether the restraints will be sustainable. And in any case, see also Figure I.1, page 5 of the 2015 Trustees’ report, and compare it to Figure II.D1 on page 17 of the 2009 report. The 2009 projection shows total Medicare costs reaching almost 12% of GDP in 2085. The worst-case 2015 estimate shows it reaching 9% by 2090. So the worst-case projection after Obamacare is actually better than the standard projection before Obamacare.

The chart: See Table 1, page 6 here.

Page 15 panel 3: A Better Way, policy paper, page 36 para 1.

Page 15, panel 4: A Better Way, policy paper, page 36 para 3.

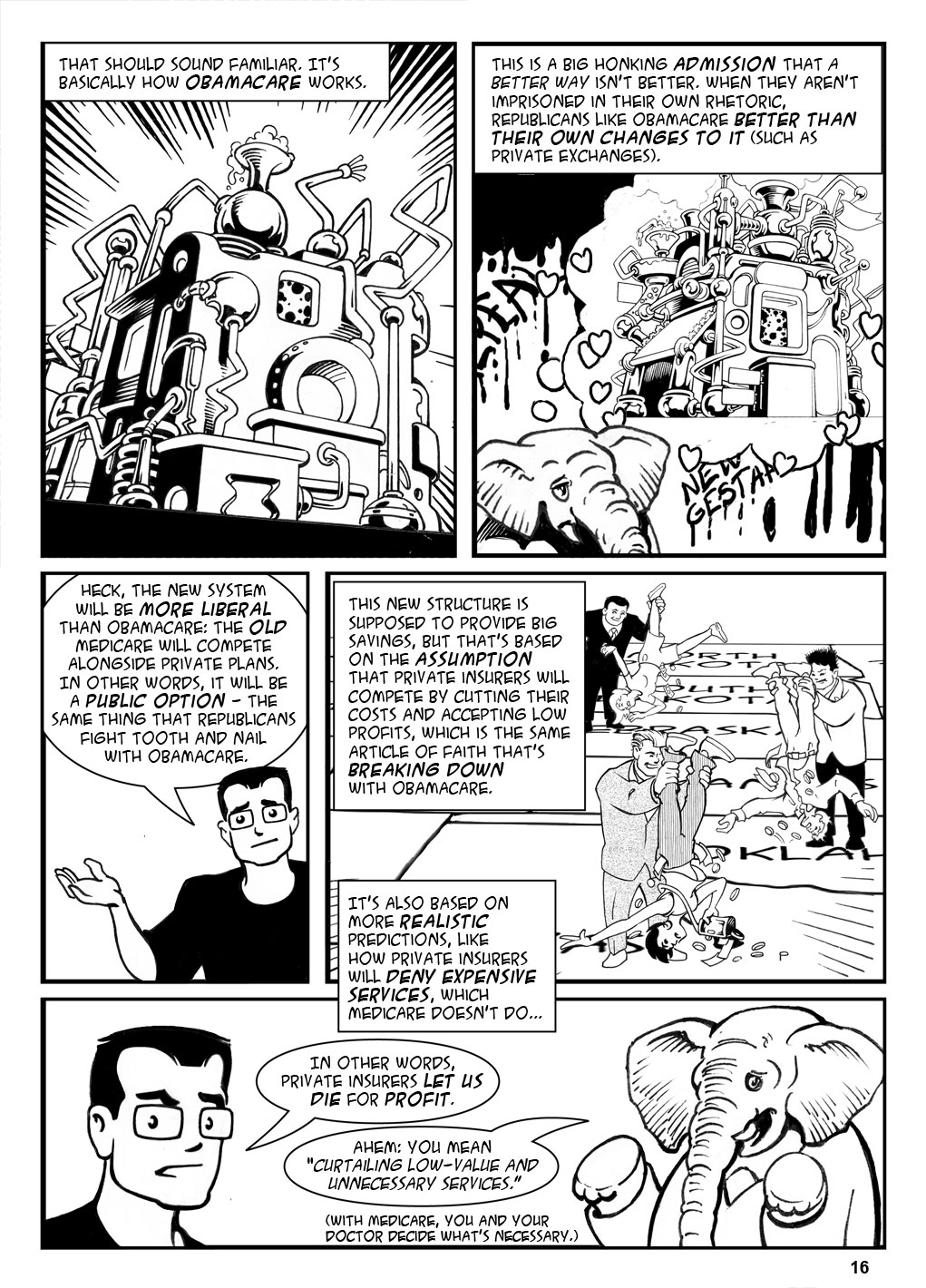

Page 16, panel 1: I’m not the only person to think this; see, for instance, Alison Kodjak, Paul Ryan’s plan to change Medicare looks a lot like Obamacare, http://www.npr.org/sections/health-shots/2016/11/26/503158039/pa…edium=social&utm_campaign=npr&utm_term=nprnews&utm_content=2053.

Page 16, panel 3: A Better Way policy paper, page 36 panel 3.

Page 16, panel 4: These claims are referenced to a CBO document, A Premium Support System for Medicare; Analysis of Illustrative Options, available here. The lower administrative costs and profits claim comes from page 19 para 1.

Page 16 panel 5: A Premium Support System for Medicare, page 19 para 1 (“constraining the volume and intensity of health services provided”).

Elephant’s quote: A Better Way, policy paper, Page 33, bullet 2.

Page 17 panel 1: A Premium Support System for Medicare, page 4 last paragraph.

Page 17 panel 3: The CBO document, oddly, assumes that including current Medicare as an option will keep prices low because Medicare pays less than private plans (see page 8). But then on page 19 para 3 it says the obvious: Medicare can do that because it has the bargaining power that comes from being huge, and this aspect of cost will go up in a “competitive” environment.

Page 17 panel 4 (the text box): A Premium Support System for Medicare, page 62 Table 1 shows that the maximum savings expected is 6%.

Page 17 panel 5 (the scale): Won’t offset: Henry Kaiser Foundations, What Are the Implications of Repealing the Affordable Care Act for Medicare Spending and Beneficiaries?

Nerfing the Independent Payment Advisory Board: If Medicare’s expenses rise too high, the IPAB can make recommendations to cut costs; unlike with previous boards, these cuts are enacted unless a supermajority of Congress decides against it. A Better Way wants to take this power away, and there are good arguments for it–“cutting costs” in this case is basically “cutting payments,” and really supermajorities should be reserved for grave questions like treaties, not for reimbursement rates. But nerfing the panel will raise costs.

Pointlessly subsidizing Medicare Advantage plans: MA plans are private plans that take Medicare money and provide coverage to Medicare patients rather than doing it through Medicare. Before Obamacare, Medicare paid 12% more for each patient on an MA plan, which was a subsidy of the insurers who issued them. Obamacare brought that subsidy down to 2%, which is quite reasonable, and more patients than ever are on MA plans, so restoring the subsidy is pointless. Unless you’re an insurer.

Page 17 panel 6: 30% less: https://www.cbo.gov/publication/45552#section1 (the range given is 20%-38%).

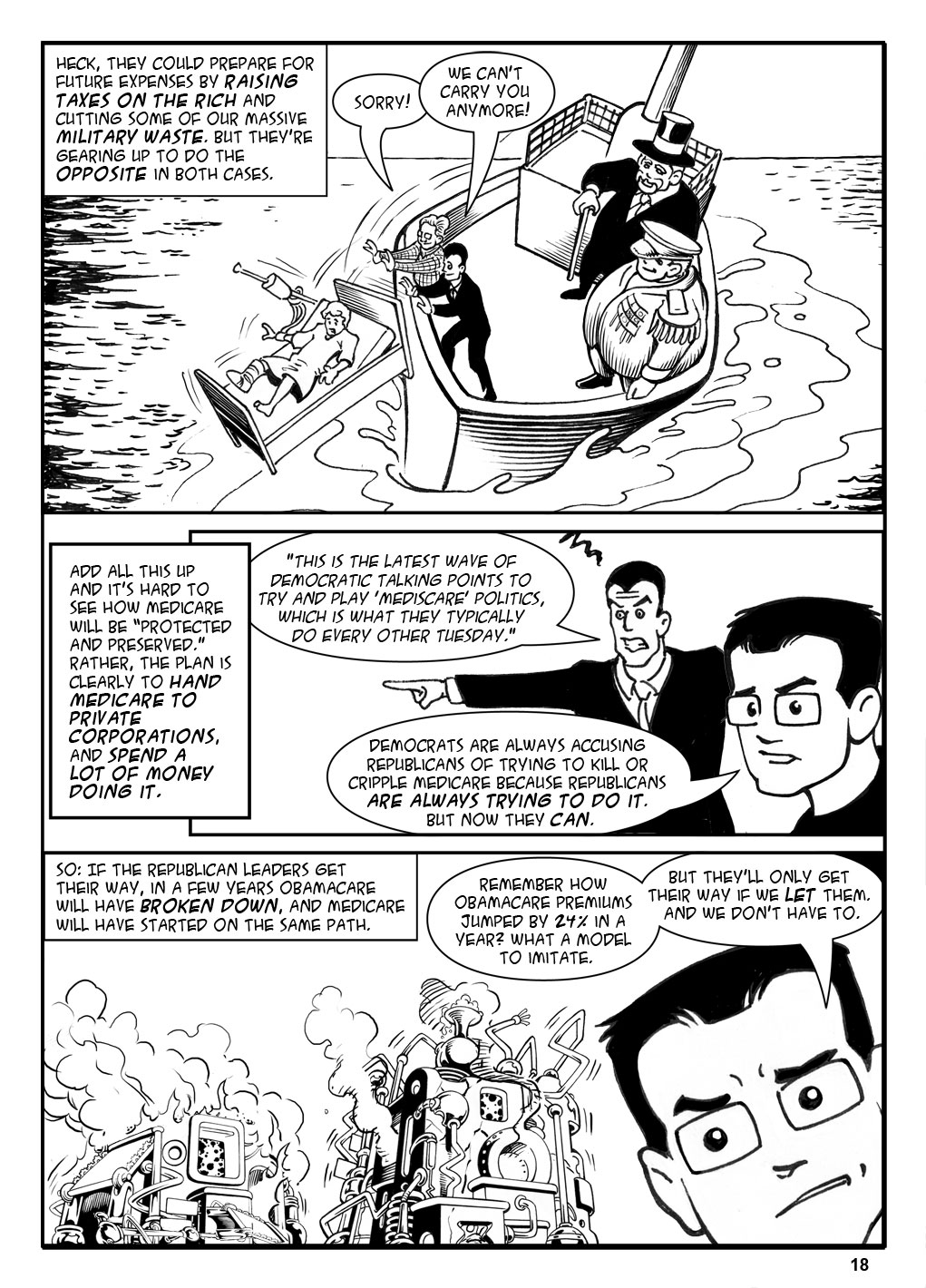

Page 18 panel 2: Ryan quoted in The Hill, 12/1/16. Spend a lot of money doing it: They’re actually being pretty open about this—they’re willing to drive up the debt to kill health care. https://www.washingtonpost.com/powerpost/conservatives-ready-to-support-1-trillion-hole-in-the-budget/2017/01/05/76d4bf34-d391-11e6-a783-cd3fa950f2fd_story.html?utm_term=.60f998262f8a.